Avant Brands Reports Record Q1 Net Revenue and Outperforms Revenue Guidance

- Gross Revenue Outperforms Guidance: Achieved $8.9 million in Gross Revenues, outperforming the guidance range of $8.2 million to $8.7 million.

- Trending Revenue Growth: Record Net Revenue increased 15% to $8.1 million.

- International Expansion Surge: Global sales increased 21% to a record of $3.3 million, underscoring strong demand for Avant's premium products internationally.

- Enhanced Profitability: Achieved a record Adjusted EBITDA2 of $3.8 million, marking substantial growth and operational efficiency.

KELOWNA, BC / ACCESSWIRE / April 15, 2024 / Avant Brands Inc (TSX:AVNT)(OTCQX:AVTBF)(FRA:1BUP) ("Avant" or the "Company"), a leading producer of innovative and award-winning cannabis products, today released its financial results for the first quarter ended February 29, 2024 ("Q1 2024"). Driven by a continued focus on strategic international expansion and operational improvements, the Company achieved significant financial milestones.

In Q1 2024, Avant Brands reports records across key financial metrics, underscoring the Company's commitment to operational excellence. These highlights include:

- Record Net Revenues: Increased 15% to $8.1 million compared to Q1 2023, demonstrating sustained growth as the Company continues to experience significant demand internationally.

- International Sales Surge: International sales increased to a record of $3.3 million, representing a 21% increase over Q1 2023, reflecting the success of Avant's premium flower in global markets, with sales accounting for 37% of total gross revenue. This was driven by Avant's aggressive market penetration in key regions such as Australia, Germany and Israel.

- Significant Margin Improvement: Increasing production output resulted in record kilograms ("KG") produced, resulting in lower production costs per gram and significantly increased Gross Margin3.

- Enhanced Profitability: Achieved a record Adjusted EBITDA2 of $3.8 million, marking a substantial 120% increase.

- Cash Flow from Operations1: Increased to $3.8 million.

- Sustained Results: Adjusted EBITDA2 was positive for six of the past seven quarters, with seven consecutive quarters of positive Cash Flow from Operations1.

- Adjusted Net Income6: Achieved a record of $1.2 million, demonstrating significant improvement attributed to effective cost-control measures and increased sales, further bolstering the Company's profitability.

Avant Brands Founder & CEO Norton Singhavon Comments:

"Despite facing short-term challenges in late 2023, Avant Brands is pleased to report record-breaking Q1 2024 results across all key metrics. This achievement signifies a successful return to our growth trajectory. Our team's unwavering commitment to production increases, sales growth, and cost reduction has played a pivotal role in driving this turnaround. We are confident that by staying relentless in adhering to these core principles, we will achieve continued growth as we execute our global expansion strategy."

Fiscal Q1 2024 Financial Highlights (vs. Fiscal Q1 2023):

Record Revenue Growth:

- Gross Revenue: $8.9 million

- Net Revenue: Record of $8.1 million (+15%)

- International Revenue: Record $3.3 million (+21%)

- Canadian Recreational Revenue: $3.4 million (-19%)

- Domestic B2B Revenue: $1.3 million (vs. $0.06 million)

Record Gross Margin3 (before fair value adjustments):

- Gross Margin3 dollars: Record of $4.7 million (+61%)

- Gross Margin3 percentage: Increased to 58% (vs. 42%)

- Canadian Recreational Gross Margin3: Record of 63% (vs. 47%)

- Export Gross Margin3: Record of 74% (vs. 31%)

Record Production and Sales:

- Cannabis Production: Record of 3,231 KG (+23%), with five consecutive quarters of record production

- Cannabis Sales: Record 2,785 KG sold (+96%)

Average Selling Prices Across Key Channels:

- International Selling Price (on-spec product): $4.30 per gram

- Recreational Cannabis Selling Price (net of excise): $5.49 per gram (vs. $6.00)

- Weighted Average Selling Price: Decreased to $3.18 per gram (vs. $5.08)

The decrease in the weighted average selling price was due to liquidating off-spec inventory through domestic wholesale channels. Recreational cannabis prices declined with the Flowr brand relaunch, which has a lower price point than BLK MKTTM and TenzoTM. Notably, Avant's international sales and recreational brands maintained their pricing integrity, demonstrating resilience against pricing pressures.

Optimizing Cash Flows:

- Cash Flow from Operations1: Increased to $3.8 million (+114%), achieving seven consecutive quarters of positive Cash Flow from Operations1

Operational Efficiency:

- SG&A and Corporate Expenses5: Decreased to $2.5 million (-14%)

Record Trends in Profitability Metrics:

- Adjusted EBITDA2: Record of $3.8 million (+120%)

- Adjusted EBITDA Margin2 of Net Revenue: Record of 47% (vs. 24%)

- Adjusted Net Income6: Record of $1.2 million (+403%)

Avant Brands CFO, Jeremy Wright Comments:

"I'm thrilled by Avant Brands' outstanding Q1 2024 performance. I'm impressed by the efforts of our sales and operations teams, which are driving record-breaking results. Our strong financial performance, including record net revenue and substantial growth in cash flow from operations, reflects the effectiveness of our strategies. With continued focus, we'll sustain this momentum and drive further growth. It's an exciting time to be back with the team."

Fiscal Q1 2024 Corporate Highlights

- Rapidly Growing International Demand: Avant's aggressive pursuit of international growth led to the establishment of partnerships with five new entities across Australia, Germany, and Israel, tapping into a combined population exceeding 120 million. Notably, the Company maintains a flawless track record, achieving 100% collection on all international sales and brand licensing revenue.

- Enhancing Financial Flexibility: Avant prioritized financial flexibility by restructuring loan agreements, aiming to bolster its ability to navigate dynamic market conditions. This provides Avant with the flexibility to manage its strong cash flow from operations and prioritize initiatives to increase sales in Canada and internationally.

Key Subsequent Events

- Cultivar Expansion: Avant Brands broadens its cultivar offerings to meet rising global demand.

- Strategic Team Growth: Avant strengthens its leadership with Sukhie Chahal, VP of Revenue Strategy (previously at Canopy Growth), and Tyson Macdonald - Board of Directors (previously at Acreage Holdings).

- International Brand Recognition: Avant partners with IM Cannabis to launch BLK MKTTM in Germany, tapping into the recently announced recreational legalization. This positions BLK MKTTM to become a prominent player in what is anticipated to be the largest recreational cannabis market globally.

Avant Brands Strategic Priorities for Fiscal 2024

1. Market Expansion and International Growth

Avant Brands recognizes the immense potential of international cannabis markets. Leveraging our brand reputation and quality recognition, the Company will prioritize the following strategic initiatives for the remainder of fiscal 2024:

- Target High-Potential Markets: From Germany's recent legalization (serving a population of 84 million) to emerging markets, Avant will strategically expand its global reach.

- Secure Additional Clients: As one of Canada's largest indoor producers, the Company is well-positioned to continue expanding its international sales and actively seek partnerships in the UK, Switzerland, and other emerging markets.

2. BLK MKTTM: Building a Global Icon

The Company's flagship brand, BLK MKTTM, is well-positioned for global recognition. Key initiatives to support this include:

- Strategic Licensing Partnerships: With a priority to expand BLK MKTTM beyond Israel and Germany, the Company is in active discussions to launch the BLK MKTTM brand in Australia, solidifying its status as a premium cannabis icon.

3. Revenue Growth and Strong Partnerships

Avant Brands remains committed to strong international partnerships:

- Successful Deliveries: Initial shipments to a new international client are complete, reinforcing our commitment to reliability.

- Repeat Business: Avant anticipates continued shipments as we continue building trust and reliability amongst new and existing clients.

4. Driving Efficiency and Quality for Sustainable Growth

Efficiency and quality are the cornerstones of Avant's operations. This commitment is evident in our recent achievements:

- Increased Production & Reduced Costs: Avant expanded its production capacity by 50% through the Flowr acquisition while simultaneously achieving a 14% reduction in SG&A and corporate overhead. This demonstrates effective cost-control strategies that support sustainable growth.

- Quality at Scale: As we scale our global footprint, maintaining the highest quality standards remains paramount.

5. Driving Canadian Recreational Sales:

Avant Brands is committed to capturing a significant share of the Canadian recreational cannabis market. We will achieve this through:

- Brand Building & Marketing: Implementing strategic marketing campaigns and activations to elevate brand awareness and recognition among Canadian consumers.

- Product Diversification: Optimizing our product portfolio to cater to diverse and evolving trends and market segments.

- Distribution Network Optimization: Strengthening our relationships with provincial cannabis boards and key retailers to ensure wider product availability across Canada.

6. Innovation and Consumer Trends

- Staying ahead of the curve: Avant Brands will introduce exciting new cultivars, keeping ahead of evolving consumer trends.

Download the Company's Updated Corporate Presentation:

https://avantbrands.ca/investor/#presentation

Fiscal Q1 2024 Earnings Conference Call Details

A conference call with management will be held on Tuesday, April 16th, 2024, at 1 PM PT (4 PM ET) to discuss Avant's 2024 Q1 earnings.

Conference Call Dial Details:

Canada/USA TF: +1-800-319-4610

International Toll: +1-604-638-5340

Callers are encouraged to dial in 5 minutes in advance to ensure a timely connection to the call.

A transcript of the call will be posted on the Company's website at www.avantbrands.ca within 48 hours of the call.

For those seeking a deeper understanding of the Company's financial performance, the financial statements for the quarter ended February 29, 2024 (the "Financial Statements"), along with the related management discussion & analysis (the "MD&A"), will be available for download on the Company's SEDAR+ profile at www.sedarplus.ca or directly from the Company's website.

Your participation is valued as we discuss our achievements, strategies, and vision for the future during this insightful conference call.

About Avant Brands Inc.

Avant is an innovative, market-leading premium cannabis company. Avant has multiple operational production facilities across Canada, which produce high-quality, handcrafted cannabis products based on unique and exceptional cultivars.

Avant offers a comprehensive product portfolio catering to recreational, medical, and export markets. Our renowned consumer brands, including BLK MKT™, Tenzo™, Cogn?scente™, flowr™ and Treehugger™, are available in key recreational markets across Canada. Avant's products are distributed globally to Australia, Israel and Germany, with its flagship brand BLK MKT™ currently being sold in Israel. Additionally, Avant's medical cannabis brand, GreenTec™, serves qualified patients nationwide through its GreenTec Medical portal and trusted medical cannabis partners.

Avant is a publicly traded corporation listed on the Toronto Stock Exchange (TSX: AVNT) and accessible to international investors through the OTCQX Best Market (OTCQX:AVTBF) and Frankfurt Stock Exchange (FRA: 1BU0). Headquartered in Kelowna, British Columbia, Avant operates in strategic locations, including British Columbia, Alberta, and Ontario.

For more information about Avant, including access to investor presentations and details about its consumer brands, please visit www.avantbrands.ca.

For further inquiries, please contact:

Investor Relations at Avant Brands Inc.

1-800-351-6358

[email protected]

Note 1 - Cash Flows from Operations before changes in net-working capital is a non-IFRS performance measure and is calculated by adjusting the net loss from continuing operations for items not affecting cash, before applying changes in non-cash operating working capital.

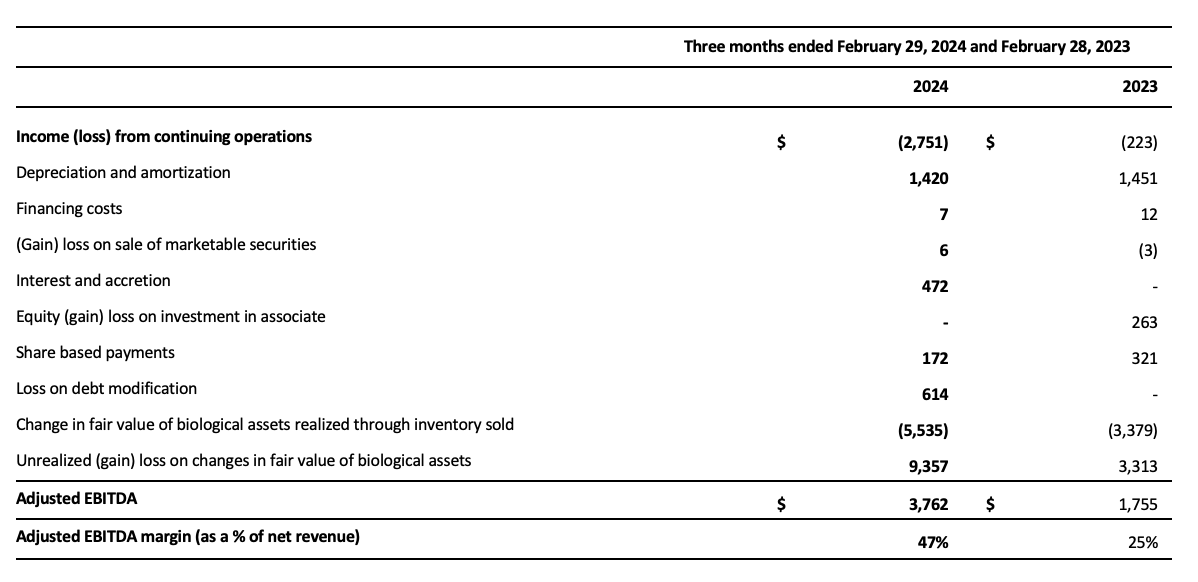

Note 2 - Adjusted EBITDA and Adjusted EBITDA Margin are non-IFRS measures. The Company calculates Adjusted EBITDA from continuing operations as net income (loss) before interest expense, income taxes, depreciation and amortization, unrealized gain (loss) on changes in fair value of biological assets, equity loss on investment in associate, loss on sale of assets, investment loss and share based payments. The Company calculates Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Net Revenue. Management determined that the exclusion of the fair value adjustment is an alternative representation of performance. The fair value adjustment is a non-cash gain (loss) and is based on fair market value less cost to sell. The most directly comparable measure to Adjusted EBITDA (excluding fair value adjustment to biological assets and inventory) calculated in accordance with IFRS is net income (loss) from continuing operations. For more information on the reconciliation of Adjusted EBITDA to net income (loss) and Adjusted EBITDA Margin, please refer to the MD&A or view the reconciliation table at the end of this news release.

Note 3 - Gross margin before fair value adjustments. Please refer to the Financial Statements and MD&A for definitions and a reconciliation to IFRS.

Note 5 - Selling, General and Administrative Expenses and Corporate Expenses are Operating Expenses as listed in the Financial Statements.

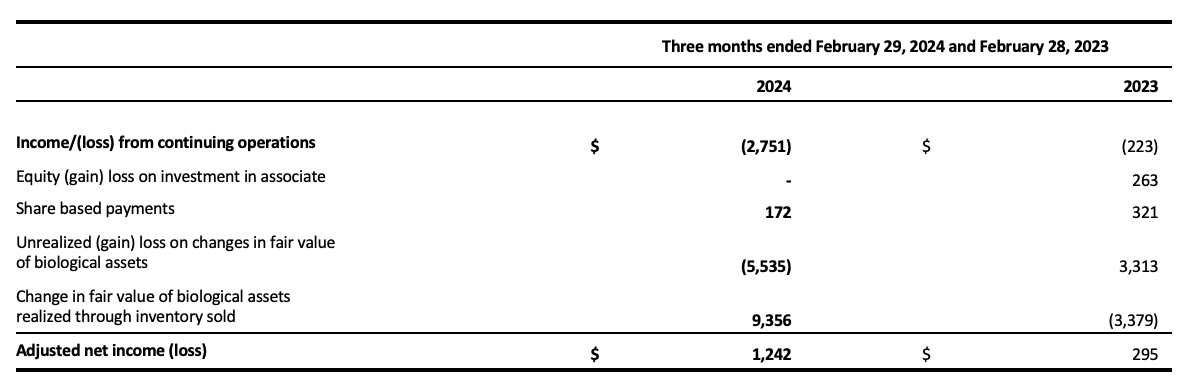

Note 6 - Adjusted Net Income is a non-IFRS performance measure and is calculated by adjusting the net income for items not affecting cash such as; equity loss on investment in associate, share based payments, fair value gain on acquisition, and fair value changes on biological assets. The Company has elected to report Adjusted Net Income, which is a non-IFRS measure, as it believes this metric provides more accurate results of the Company's financial performance to readers, as it removes the fair value changes on biological assets (amongst other minor adjustments). The most directly comparable measure to Adjusted Net Income calculated in accordance with IFRS is net income (loss) from continuing operations. For more information on the reconciliation of Adjusted Net Income, please refer to the MD&A at page 10 or view the reconciliation table at the end of this news release.

RECONCILIATION OF ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

ADJUSTED EBITDA (NON-IFRS PERFORMANCE MEASUREMENT)

The Company has identified Adjusted EBITDA and Adjusted EBITDA Margin as relevant industry performance indicators. Adjusted EBITDA and Adjusted EBITDA Margin are non-IFRS financial measures used by management that do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies.

Management defines Adjusted EBITDA as income (loss) from continuing operations, as reported, adjusted for depreciation and amortization, equity (gain) loss on investment in associate, financing costs, gains and losses on sale of marketable securities, Canadian emergency wage subsidy, interest and accretion, share-based payments, fair value gain on acquisition, impairment of inventory, change in fair value of biological assets realized through inventory sold, and unrealized gains and losses on changes in fair value of biological assets. Management calculates Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Net Revenue. Management believes these measures provide useful information as commonly used measures in the capital markets to approximate operating earnings. See table below for determination of specific components of Adjusted EBITDA and Adjusted EBITDA Margin.

RECONCILIATION OF ADJUSTED NET INCOME (LOSS)

ADJUSTED NET INCOME (LOSS) NON-IFRS PERFORMANCE MEASUREMENT

The Company has identified adjusted net income as a relevant industry performance indicator. Adjusted net income is a non-IFRS financial measure used by management that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies.

Management defines adjusted net income as income (loss) from continuing operations, as reported, adjusted for equity (gain) loss on investment in associate, share-based payments, fair value gain on acquisition, change in fair value of biological assets realized through inventory sold, and unrealized gains and losses on changes in fair value of biological assets. Management believes this measure provides useful information as it is a commonly used measure in the capital markets to approximate operating earnings. See the table below for the determination of specific components of adjusted net income.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION:

This news release includes certain "forward-looking information" as defined under applicable Canadian securities legislation, encompassing statements regarding Avant Brands Inc.'s ("Avant" or the "Company") plans, intentions, beliefs, and current expectations concerning future business activities and operating performance. Forward-looking information is often identified by words such as "may," "would," "could," "should," "will," "intend," "plan," "anticipate," "believe," "estimate," "expect," or similar expressions. It covers various aspects, including the Company's expectations for future revenue growth, demonstrated by its record Q1 net revenue exceeding revenue guidance. Additionally, it includes plans for international market expansion, such as the surge in international sales and securing agreements with new international partners, becoming a prominent player in Germany, reflecting Avant's strategic initiatives. Furthermore, the forward-looking information addresses the Company's efforts in brand building, particularly in establishing and strengthening its premium cannabis brands like BLK MKT™. It also encompasses strategies for product development to meet evolving consumer preferences and market trends, as well as the focus on maintaining cost controls and operational efficiencies to enhance profitability and financial performance, and the company's expected continued growth. Moreover, the forward-looking information considers the anticipated performance of the BLK MKTTM brand in the global cannabis industry, supported by successful international expansion and strategic partnerships. Lastly, it mentions the expected availability of the Audited Financial Statements and the MD&A on the Company's SEDAR+ profile and website, providing investors with comprehensive financial information. Investors should be aware that forward-looking information involves inherent risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied by such information. Management's current expectations may not accurately predict future events or outcomes. Therefore, investors are cautioned not to place undue reliance on forward-looking information.

Investors are cautioned that forward-looking information is not based on historical fact but instead reflects management's expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although the Company believes that the expectations reflected in such forward-looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the Company. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are the following: regulatory and licensing risks; changes in consumer demand and preferences; changes in general economic, business and political conditions, including changes in the financial markets; the global regulatory landscape and enforcement related to cannabis, including political risks and risks relating to regulatory change; compliance with extensive government regulation; public opinion and perception of the cannabis industry; the impact of COVID-19; and the risk factors set out in the Company's annual information form dated February 27, 2023, filed with Canadian securities regulators and available on the Company's profile on SEDAR+ at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors that could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information, which speak only as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

This news release refers to certain financial performance measures that are not defined by and do not have a standardized meaning under International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board. These non-IFRS financial performance measures are defined in the MD&A. Non-IFRS financial measures are used by management to assess the financial and operational performance of the Company. The Company believes that these non-IFRS financial measures, in addition to conventional measures prepared in accordance with IFRS, enable investors to evaluate the Company's operating results, underlying performance and prospects in a similar manner to the Company's management. As there are no standardized methods of calculating these non-IFRS measures, the Company's approaches may differ from those used by others, and accordingly, the use of these measures may not be directly comparable. Accordingly, these non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

SOURCE: Avant Brands Inc.

View the original press release on accesswire.com

These press releases may also interest you

|

News published on and distributed by: