Subjects: ECO, STP

A surge in mortgage rates and elevated home prices dampened California's housing affordability in fourth-quarter 2022, C.A.R. reports

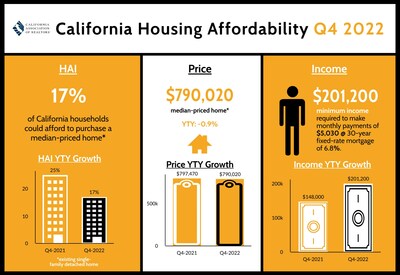

- Seventeen percent of California households could afford to purchase the $790,020 median-priced home in the fourth quarter of 2022, down from 18 percent in third-quarter 2022 and down from 25 percent in fourth-quarter 2021.

- A minimum annual income of $201,200 was needed to make monthly payments of $5,030, including principal, interest and taxes on a 30-year fixed-rate mortgage at a 6.80 percent interest rate.

- More than one in four (26 percent) California home buyers were able to purchase the $610,000 median-priced condo or townhome. A minimum annual income of $155,200 was required to make a monthly payment of $3,880.

- Infographic: https://www.car.org/Global/Infographics/HAI-2022-Q4

LOS ANGELES, Feb. 9, 2023 /PRNewswire/ -- A rapid rise in mortgage interest rates depressed housing affordability in California during the fourth quarter of 2022 and pushed the statewide affordability index for an existing, single-family home to 17 percent, just above the 15-year low of 16 percent recorded in the second quarter of 2022, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California dipped to 17 percent in fourth-quarter 2022 from 18 percent in the third quarter of 2022 and was down from 25 percent in the fourth quarter of 2021, according to C.A.R.'s Traditional Housing Affordability Index (HAI). California hit a peak high affordability index of 56 percent in the first quarter of 2012.

C.A.R.'s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The index is considered the most fundamental measure of housing well-being for home buyers in the state.

A minimum annual income of $201,200 was needed to qualify for the purchase of a $790,020 statewide median-priced, existing single-family home in the fourth quarter of 2022. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $5,030, assuming a 20 percent down payment and an effective composite interest rate of 6.80 percent. The effective composite interest rate was 5.72 percent in third-quarter 2022 and 3.28 percent in fourth-quarter 2021.

While the cost of borrowing was the highest in over two decades, recent encouraging inflation data has allowed the Federal Reserve to scale down its rate hikes to 25 basis points in its latest February Federal Open Market Committee meeting. In anticipation of the Fed's less aggressive push on rate increases in the last couple of months, the market has had less upward pressure on yields, which resulted in the average 30-year fixed-rate-mortgage (FRM) trending down since it peaked at just over 7 percent in late October/early November.

The statewide median price of an existing single-family home in California dipped on a year-over-year basis in the fourth quarter of 2022 for the first time in 11 years. It also experienced the second largest quarter-to-quarter decline since the first quarter of 2011. Home prices are expected to soften further in the upcoming quarter as rates remain elevated, which will continue to put some downward pressure on housing demand.

Despite a moderate quarter-to-quarter drop in the median condo/townhome price, the share of households in California that could afford to buy a median-priced condo/townhome continued to slide from last year as the cost of borrowing remained on the rise. Twenty-six percent of California households earned the minimum income to qualify for the purchase of a $610,000 median-priced condo/townhome in the fourth quarter of 2022, which required an annual income of $155,200 to make monthly payments of $3,880. The fourth quarter 2022 figure was down from 36 percent a year ago.

Nationwide housing affordability also slipped in fourth-quarter 2022. Compared with California, 38 percent of the nation's households could afford to purchase a $378,700 median-priced home, which required a minimum annual income of $96,400 to make monthly payments of $2,410. Nationwide affordability was 51 percent a year ago.

Key points from the fourth-quarter 2022 Housing Affordability report include:

- Compared to the previous quarter, housing affordability in the fourth quarter of 2022 improved in 10 counties, remained unchanged in 13 counties and declined in 28 counties. Not one single county saw an improvement in affordability from a year ago, although Tehama and San Mateo counties remained unchanged on a year-over-year basis.

- In the nine-county San Francisco Bay Area, affordability declined from the previous quarter in Solano and Sonoma, , increased in Napa, and remained flat in the other six counties.

- In the Southern California region, housing affordability fell in four counties from third-quarter 2022 and remained unchanged in two counties. San Bernardino County was the most affordable in the region at 29 percent of households able to purchase the $458,000 median-priced home.

- In the Central Valley region, Glenn and Kings counties were the most affordable at 35 percent, and San Benito was the least affordable at 18 percent.

- In the Central Coast region, Santa Cruz County was the most affordable at 13 percent, and Santa Barbara County and San Luis Obispo were the least affordable at 11 percent.

- For the state as a whole, Lassen (54 percent) remained the most affordable county in California in the fourth quarter of 2022, followed by Tehama (40 percent) and Shasta (39 percent). These three counties were also the only counties whose affordability index was higher than the national index of 38 percent. Lassen also had the lowest minimum qualifying income ($59,200) of all counties in California to purchase a median-priced home and was the only county in the state with a qualifying income less than $60,000.

- Mono (7 percent) and a two-way-tie between Santa Barbara and San Luis Obispo at 11 percent, were the least affordable counties in California, with each of them requiring a minimum income of at least $210,000 to purchase a median-priced home in the respective counties. San Mateo County continued to require the highest minimum qualifying income to buy a median-priced home in fourth-quarter 2022 and was one of four counties in California ? all in the Bay Area ? that required a minimum qualifying income of more than $400,000 in the fourth quarter of 2022. Other counties with a minimum qualifying income over $400,000 include Marin ($402,400), Santa Clara ($401,600) and San Francisco ($401,200).

- On a year-over-year basis, housing affordability declined the most in Kings County, falling 18 points from fourth-quarter 2021 to fourth-quarter 2022. Del Norte and Lake followed closely behind, with each county dropping 15 points year-over-year in the last quarter of 2022. The surge in mortgage rates, along with elevated home prices, continued to be the primary factors for the plunge in affordability in these counties.

See C.A.R.'s historical housing affordability data.

See first-time buyer housing affordability data.

Leading the way...® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 214,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

CALIFORNIA ASSOCIATION OF REALTORS® | ||||||||

4th Quarter 2022 | C.A.R. Traditional Housing Affordability Index | |||||||

STATE/REGION/COUNTY | 4th Qtr. | 3rd Qtr. | 4th Qtr. | Median | Monthly | Minimum | ||

Calif. Single-family homes | 17 | 18 | 25 | $790,020 | $5,030 | $201,200 | ||

Calif. Condo/Townhomes | 26 | 27 | 36 | $610,000 | $3,880 | $155,200 | ||

Los Angeles Metro Area | 18 | 19 | 26 | $729,000 | $4,640 | $185,600 | ||

Inland Empire | 23 | 25 | 35 | $540,000 | $3,440 | $137,600 | ||

San Francisco Bay Area | 20 | 20 | 23 | $1,199,000 | $7,630 | $305,200 | ||

United States | 38 | 39 | 51 | $378,700 | $2,410 | $96,400 | ||

San Francisco Bay Area | ||||||||

Alameda | 17 | 17 | 20 | $1,165,000 | $7,420 | $296,800 | ||

Contra Costa | 25 | 25 | 33 | $840,000 | $5,350 | $214,000 | ||

Marin | 18 | 18 | 23 | $1,580,000 | $10,060 | $402,400 | ||

Napa | 16 | 13 | 24 | $920,000 | $5,860 | $234,400 | ||

San Francisco | 20 | 20 | 21 | $1,575,000 | $10,030 | $401,200 | ||

San Mateo | 19 | 19 | 19 | $1,800,000 | $11,460 | $458,400 | ||

Santa Clara | 20 | 20 | 22 | $1,577,500 | $10,040 | $401,600 | ||

Solano | 28 | 30 | 42 | $569,000 | $3,620 | $144,800 | ||

Sonoma | 17 | 19 | 28 | $805,000 | $5,130 | $205,200 | ||

Southern California | ||||||||

Los Angeles | 13 | 14 | r | 20 | r | $829,130 | $5,280 | $211,200 |

Orange | 13 | 13 | 17 | $1,132,000 | $7,210 | $288,400 | ||

Riverside | 21 | 23 | 32 | $585,000 | $3,730 | $149,200 | ||

San Bernardino | 29 | 31 | 42 | $458,000 | $2,920 | $116,800 | ||

San Diego | 15 | 15 | 23 | $857,000 | $5,460 | $218,400 | ||

Ventura | 16 | 17 | 24 | $850,000 | $5,410 | $216,400 | ||

Central Coast | ||||||||

Monterey | 12 | 13 | 19 | $828,000 | $5,270 | $210,800 | ||

San Luis Obispo | 11 | 13 | 22 | $843,000 | $5,370 | $214,800 | ||

Santa Barbara | 11 | 12 | 20 | $975,000 | $6,210 | $248,400 | ||

Santa Cruz | 13 | 14 | 17 | $1,275,000 | $8,120 | $324,800 | ||

Central Valley | ||||||||

Fresno | 30 | 32 | 40 | $399,000 | $2,540 | $101,600 | ||

Glenn | 35 | 34 | 43 | $307,000 | $1,950 | $78,000 | ||

Kern | 30 | 34 | 43 | $374,900 | $2,390 | $95,600 | ||

Kings | 35 | 40 | 54 | $330,000 | $2,100 | $84,000 | ||

Madera | 31 | 34 | 42 | $410,000 | $2,610 | $104,400 | ||

Merced | 34 | 34 | 45 | $360,000 | $2,290 | $91,600 | ||

Placer | 29 | 30 | 39 | $630,000 | $4,010 | $160,400 | ||

Sacramento | 28 | 29 | 39 | $500,000 | $3,180 | $127,200 | ||

San Benito | 18 | 20 | 27 | $760,000 | $4,840 | $193,600 | ||

San Joaquin | 28 | 29 | 38 | $496,500 | $3,160 | $126,400 | ||

Stanislaus | 29 | 30 | 40 | $429,000 | $2,730 | $109,200 | ||

Tulare | 32 | 36 | 44 | $359,900 | $2,290 | $91,600 | ||

Far North | ||||||||

Butte | 29 | 30 | 35 | $429,500 | $2,730 | $109,200 | ||

Lassen | 54 | 56 | 63 | $232,500 | $1,480 | $59,200 | ||

Plumas | 31 | 28 | 39 | $396,940 | $2,530 | $101,200 | ||

Shasta | 39 | 39 | 45 | $355,000 | $2,260 | $90,400 | ||

Siskiyou | 31 | 31 | 44 | $325,000 | $2,070 | $82,800 | ||

Tehama | 40 | 39 | 40 | $290,000 | $1,850 | $74,000 | ||

Other CA Counties | ||||||||

Amador | 34 | 34 | 43 | $389,000 | $2,480 | $99,200 | ||

Calaveras | 30 | 32 | 40 | $440,000 | $2,800 | $112,000 | ||

Del Norte | 25 | 27 | 39 | $375,000 | $2,390 | $95,600 | ||

El Dorado | 25 | 27 | 37 | $635,000 | $4,040 | $161,600 | ||

Humboldt | 24 | 23 | 30 | $435,000 | $2,770 | $110,800 | ||

Lake | 28 | 33 | 43 | $349,900 | $2,230 | $89,200 | ||

Mariposa | 27 | 21 | 30 | $359,000 | $2,290 | $91,600 | ||

Mendocino | 14 | 18 | 22 | $562,500 | $3,580 | $143,200 | ||

Mono | 7 | 8 | 13 | $825,000 | $5,250 | $210,000 | ||

Nevada | 27 | 25 | 37 | $526,000 | $3,350 | $134,000 | ||

Sutter | 34 | 32 | 41 | $405,950 | $2,580 | $103,200 | ||

Tuolumne | 36 | 35 | 45 | $378,000 | $2,410 | $96,400 | ||

Yolo | 24 | 24 | 33 | $600,000 | $3,820 | $152,800 | ||

Yuba | 30 | 29 | 36 | $400,000 | $2,550 | $102,000 | ||

Traditional Housing Affordability Indices (HAI) were calculated based on the following effective composite interest rates: 6.80% (4Qtr. 2022), 5.72% (3Qtr. 2022) and 3.28% (4Qtr. 2021).

SOURCE CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)

These press releases may also interest you

|

News published on and distributed by: