Subjects: ECO, STP

California housing affordability slides to lowest level in nearly 15 years in second-quarter 2022 as home prices set record highs and interest rates surge, C.A.R. reports

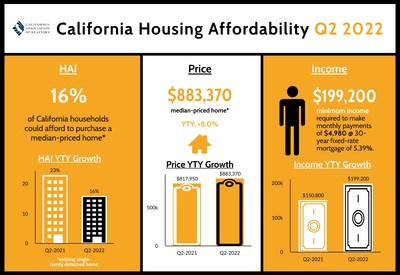

- Sixteen percent of California households could afford to purchase the $883,370 median-priced home in the second quarter of 2022, down from 24 percent in first-quarter 2022 and down from 23 percent in second-quarter 2021.

- A minimum annual income of $199,200 was needed to make monthly payments of $4,980, including principal, interest and taxes on a 30-year fixed-rate mortgage at a 5.39 percent interest rate.

- One-fourth of California home buyers were able to purchase the $677,000 median-priced condo or townhome. A minimum annual income of $152,800 was required to make a monthly payment of $3,820.

- Infographic: https://www.car.org/Global/Infographics/HAI-2022-Q2

LOS ANGELES, Aug. 11, 2022 /PRNewswire/ -- Housing affordability in California fell below 20 percent and slid to the lowest level in nearly 15 years as home prices soared to record highs in April and May and interest rates jumped to levels not seen in more than 13 years, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California in second-quarter 2022 slid to 16 percent from 24 percent in the first quarter of 2022 and was down from 23 percent in the second quarter of 2021, according to C.A.R.'s Traditional Housing Affordability Index (HAI). California hit a peak high affordability index of 56 percent in the first quarter of 2012.

C.A.R.'s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The index is considered the most fundamental measure of housing well-being for home buyers in the state.

A minimum annual income of $199,200 was needed to qualify for the purchase of a $883,370 statewide median-priced, existing single-family home in the second quarter of 2022. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $4,980, assuming a 20 percent down payment and an effective composite interest rate of 5.39 percent. The effective composite interest rate was 3.97 percent in first-quarter 2022 and 3.20 percent in second-quarter 2021. The average 30-year fixed-rate mortgage hit the highest level in more than 13 years in June as the Federal Reserve continued to raise rates aggressively in the second quarter.

With the median price of condominiums and townhomes reaching another record high in second-quarter 2022, affordability for condos and townhomes fell from the previous quarter. Twenty-five percent of California households earned the minimum income to qualify for the purchase of a $677,000 median-priced condo/townhome in the second quarter of 2022, which required an annual income of $152,800 to make monthly payments of $3,820. The second quarter 2022 figure was down from 37 percent a year ago.

Nationwide housing affordability also plunged in second-quarter 2022. Compared with California, nearly four in ten (38 percent) of the nation's households could afford to purchase a $413,500 median-priced home, which required a minimum annual income of $93,200 to make monthly payments of $2,330. Nationwide affordability was a revised 49 percent a year ago.

Key points from the second-quarter 2022 Housing Affordability report include:

- Compared to the previous quarter, housing affordability in the second quarter of 2022 declined in all but two of 51 counties. Affordability remained level in Glenn and Santa Cruz counties.

- In the nine-county San Francisco Bay Area, affordability declined from the previous quarter in all counties. Alameda County and Napa tied for the least affordable Bay Area counties, at just 15 percent of households able to purchase the $1,500,000 and $1,005,000 median-priced home, respectively. Twenty-eight percent of Solano County households could afford the $625,000 median-priced home, making it the most affordable Bay Area county.

- In the Southern California region, housing affordability deteriorated in all counties. Orange County was the least affordable at 12 percent, while San Bernardino County was the most affordable at 30 percent of households able to purchase the $493,000 median-priced home.

- In the Central Valley region, Kings County was the most affordable at 39 percent, and San Benito was the least affordable at 17 percent.

- In the Central Coast region, Santa Barbara County was the least affordable at 10 percent, and Monterey and Santa Cruz tied for the most affordable at 13 percent.

- For the state as a whole, Lassen (54 percent) remained the most affordable county in California in the second quarter of 2022, followed by Kings (39 percent), Glenn (36 percent) and Shasta (36 percent). Lassen County also required the lowest minimum qualifying income ($58,800) of all counties in California to purchase a median-priced home and was the only county in the state with a minimum required income less than $60,000.

- Mono (6 percent), Santa Barbara (10 percent), San Luis Obispo (12 percent) and Orange (12 percent) were the least affordable counties in California, with each requiring at least a minimum income of $202,800 to purchase a median-priced home in the county. San Mateo required the highest minimum qualifying income to buy a median-priced home, surpassing the $500,000 benchmark for the first time to reach a record high of $512,000. Three other counties in California requiring a minimum qualifying income of over $400,000 in second-quarter 2022 were San Francisco ($450,800), Marin ($434,800) and Santa Clara ($428,400).

- Housing affordability declined the most on a year-over-year basis in Kings, dropping 17.1 points from the previous year. Mariposa (14.8 points) and Siskiyou (14.4 points) had the second and the third largest year-over-year dips in the latest quarter. Like the rest of the state, interest rate and home price surges from a year ago were the primary factors that led to the sharp drop in affordability in these counties.

See C.A.R.'s historical housing affordability data.

See first-time buyer housing affordability data.

Leading the way...® in California real estate for more than 110 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 217,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

CALIFORNIA ASSOCIATION OF REALTORS® | ||||||||

Second quarter 2022 | C.A.R. Traditional Housing Affordability Index | |||||||

STATE/REGION/COUNTY

| Qtr. 2 2022 | Qtr. 1 2022 | Qtr. 2 2021 | Median | Monthly | Minimum | ||

Calif. Single-family home | 16 | 24 | 23 | $883,370 | $4,980 | $199,200 | ||

Calif. Condo/Townhome | 25 | 32 | 37 | $677,000 | $3,820 | $152,800 | ||

Los Angeles Metro Area | 17 | 24 | 24 | $800,000 | $4,510 | $180,400 | ||

Inland Empire | 24 | 31 | 36 | $585,000 | $3,300 | $132,000 | ||

San Francisco Bay Area | 18 | 20 | 19 | $1,495,000 | $8,430 | $337,200 | ||

United States | 38 | 47 | 49 | r | $413,500 | $2,330 | $93,200 | |

San Francisco Bay Area | ||||||||

Alameda | 15 | 17 | 18 | $1,500,000 | $8,460 | $338,400 | ||

Contra Costa | 22 | 30 | 26 | $1,001,080 | $5,640 | $225,600 | ||

Marin | 17 | 21 | 21 | $1,928,000 | $10,870 | $434,800 | ||

Napa | 15 | 20 | 23 | $1,005,000 | $5,670 | $226,800 | ||

San Francisco | 17 | 20 | 19 | $2,000,000 | $11,270 | $450,800 | ||

San Mateo | 15 | 18 | 17 | $2,270,000 | $12,800 | $512,000 | ||

Santa Clara | 18 | 20 | 21 | $1,900,000 | $10,710 | $428,400 | ||

Solano | 28 | 37 | 40 | $625,000 | $3,520 | $140,800 | ||

Sonoma | 17 | 23 | 25 | $865,500 | $4,880 | $195,200 | ||

Southern California | ||||||||

Los Angeles | 16 | 20 | 22 | $825,650 | $4,650 | $186,000 | ||

Orange | 12 | 13 | 17 | $1,300,000 | $7,330 | $293,200 | ||

Riverside | 21 | 28 | 33 | $640,000 | $3,610 | $144,400 | ||

San Bernardino | 30 | 39 | 43 | $493,000 | $2,780 | $111,200 | ||

San Diego | 14 | 19 | 22 | $965,870 | $5,450 | $218,000 | ||

Ventura | 15 | 21 | 23 | $939,000 | $5,290 | $211,600 | ||

Central Coast | ||||||||

Monterey | 13 | 16 | 18 | $875,000 | $4,930 | $197,200 | ||

San Luis Obispo | 12 | 18 | 21 | $900,000 | $5,070 | $202,800 | ||

Santa Barbara | 10 | 12 | 13 | $1,162,500 | $6,550 | $262,000 | ||

Santa Cruz | 13 | 13 | 15 | $1,350,000 | $7,610 | $304,400 | ||

Central Valley | ||||||||

Fresno | 31 | 37 | 43 | $424,500 | $2,390 | $95,600 | ||

Glenn | 36 | 36 | 45 | $325,500 | $1,830 | $73,200 | ||

Kern | 32 | 38 | 45 | $385,000 | $2,170 | $86,800 | ||

Kings | 39 | 51 | 56 | $357,700 | $2,020 | $80,800 | ||

Madera | 32 | 38 | 44 | $420,140 | $2,370 | $94,800 | ||

Merced | 34 | 40 | 44 | $400,000 | $2,250 | $90,000 | ||

Placer | 27 | 34 | 35 | $725,000 | $4,090 | $163,600 | ||

Sacramento | 27 | 34 | 38 | $570,000 | $3,210 | $128,400 | ||

San Benito | 17 | 24 | 25 | $859,000 | $4,840 | $193,600 | ||

San Joaquin | 26 | 34 | 37 | $560,000 | $3,160 | $126,400 | ||

Stanislaus | 28 | 36 | 40 | $480,000 | $2,710 | $108,400 | ||

Tulare | 34 | 41 | 45 | $371,000 | $2,090 | $83,600 | ||

Far North | ||||||||

Butte | 28 | 33 | 33 | $465,000 | $2,620 | $104,800 | ||

Lassen | 54 | 61 | 62 | $260,000 | $1,470 | $58,800 | ||

Plumas | 32 | 36 | 39 | $424,000 | $2,390 | $95,600 | ||

Shasta | 36 | 42 | 45 | $395,000 | $2,230 | $89,200 | ||

Siskiyou | 30 | 42 | 44 | $366,000 | $2,060 | $82,400 | ||

Tehama | 33 | 35 | 38 | $347,500 | $1,960 | $78,400 | ||

Other Calif. Counties | ||||||||

Amador | 32 | 40 | 40 | $440,000 | $2,480 | $99,200 | ||

Calaveras | 29 | 35 | 37 | $500,000 | $2,820 | $112,800 | ||

DelNorte | 31 | 32 | 35 | $350,000 | $1,970 | $78,800 | ||

El Dorado | 24 | 29 | 31 | $720,000 | $4,060 | $162,400 | ||

Humboldt | 24 | 30 | 32 | $451,500 | $2,550 | $102,000 | ||

Lake | 33 | 38 | 43 | $349,000 | $1,970 | $78,800 | ||

Mariposa | 22 | 29 | 36 | $460,000 | $2,590 | $103,600 | ||

Mendocino | 15 | 24 | 23 | $580,000 | $3,270 | $130,800 | ||

Mono | 6 | 7 | 9 | $956,500 | $5,390 | $215,600 | ||

Nevada | 25 | 33 | 34 | $590,000 | $3,330 | $133,200 | ||

Sutter | 31 | 39 | 40 | $450,000 | $2,540 | $101,600 | ||

Tuolumne | 33 | 38 | 44 | $435,000 | $2,450 | $98,000 | ||

Yolo | 23 | 28 | 32 | $655,000 | $3,690 | $147,600 | ||

Yuba | 27 | 33 | 39 | $445,000 | $2,510 | $100,400 | ||

r = revised | ||||||||

Traditional Housing Affordability Indices (HAI) were calculated based on the following effective composite interest rates: 5.39% (2Qtr. 2022), 3.97% (1Qtr. 2022) and 3.20% (2Qtr. 2021).

SOURCE CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)

These press releases may also interest you

|

News published on and distributed by: