Employee Retention Credit Tax Refund Worth $26k Per Employee

LOS ANGELES, CA / ACCESSWIRE / September 24, 2022 / The Employee Retention Credit (ERC) or Employee Retention Tax Credit (ERTC) program is the last major COVID-19 financial relief program for small businesses to receive stimulus money due to the pandemic. The Internal Revenue Service (IRS) is ready to give business owners up to a $26,000 refund per employee on company payroll in 2020 and 2021. For businesses that started during COVID, there is up to $33,000 refund per employee.

"Navigating the ERC tax credit is not that simple. It's complicated and complex, with over two and a half years of updates and changes. There are many factors to consider when determining eligibility for each quarter in 2020 and 2021. Then, calculating the correct employee qualified wages per quarter, subtracting out any PPP loans received, and removing any majority owners and family members. In order to stay compliant with current IRS ERC rules and regulations, expert help is highly recommended," said Marty Stewart, Chief Strategy Officer (CSO) with Disaster Loan Advisors (DLA).

Disaster Loan Advisors focus is helping companies navigate the Employee Retention Credit tax refund program. DLA has been highly specialized in previous key business financial relief programs such as the Small Business Administration's (SBA) Economic Injury Disaster Loan (EIDL), Paycheck Protection Program (PPP), Restaurant Revitalization Fund (RRF), and now with the Employee Retention Tax Credit. DLA has created an Employee Retention Credit video to educate small businesses on how to claim the ERC Credit.

Employee Retention Credit Tax Refund from the IRS

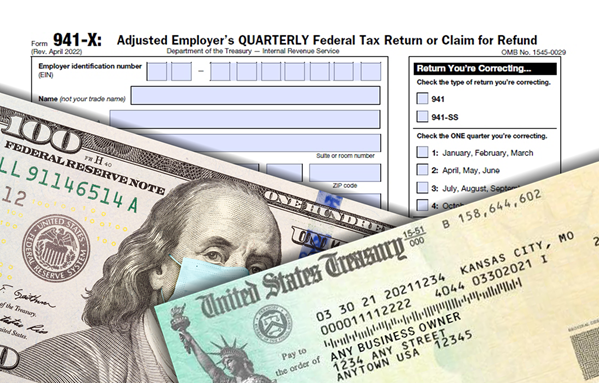

The core of the Employee Retention Credit program is that it's a tax refund from the IRS. This means filing amended IRS Form 941-X for each quarter the business qualifies for from the 2020 and 2021 tax years, in order for a business to receive the ERC refund.

The math works out to up to $5000 per employee for 2020 and up to $7000 per employee per quarter for three quarters (Q1, Q2, Q3) for 2021. This $5000 plus $21,000, totalling $26,000 is the maximum a company "could" receive per employee on payroll in 2020 and 2021.

While it seems simple, it is not. There are many factors that will, in all likelihood, be less than $26,000 per employee. Factors such as a company must qualify for a quarter, in order to then look at the qualified wages of their employees for that quarter. Then, any PPP loans that were received and forgiven, need to be deducted against the qualified wages. The IRS disallows "double dipping" and counting the same wages a business received for a PPP loan. These same wages may not be claimed for the ERC refund.

Finally, any majority owner of the business, and any family members related to the majority owner(s), must be removed from the Employee Retention Credit calculations. Only then, will the business have the accurate amount they qualify for and may claim for the ERC credit.

"Most business owners trying to do the Employee Retention Credit themselves face confusion and challenges doing this correctly. Many start trying to fill out IRS Form 941-X first. This is a mistake. The 941-X is the last step. Running through the methodical ERC qualification and calculation process, quarter-by-quarter and employee-by-employee is the first step," said Stewart.

20 Quick Facts on the Employee Retention Credit

Part of the Employee Retention Credit confusion for small business owners is the word "credit". The Employee Retention Credit is really a tax refund check sent to the business directly from the IRS.

Disaster Loan Advisors compiled a series of ERC quick facts on the Employee Retention Tax Credit, including:

- The ERC Credit is a small business tax refund from the IRS, based on W-2 payroll and wages paid during 2020 and 2021.

- It was originally introduced in March 2020 in the Coronavirus Aid Relief and Economic Security Act (CARES Act) passed by Congress.

- The ERC Credit is not a grant, not a loan, and there is no interest to pay.

- There are no restrictions on use of ERC tax refunds.

- There is up to 3 years to claim the ERC Credit.

- The ERC Credit is based on eligibility per quarter, per employee, and calculating accurately.

- Eligibility for a quarter is determined in two ways.

- Eligibility Test #1: The business experienced a significant decline in gross receipts. This is the first and easiest test to run (Gross Receipts Test) to see if a quarter qualifies. Comparing each quarter of 2020 vs. 2019, and 2021 vs. 2019. If any quarter in 2020 had a 50% or more loss in revenue (2020 vs. 2019), it qualifies. If any quarter in 2021 had a 20% or more loss in revenue (2021 vs. 2019), it qualifies.

- Eligibility Test #2: A full or partial suspension of the employer's business operations by a governmental order. This is the second test to run, on quarters that may not qualify due the the Gross Receipts Test. "Partial suspension" rules are complex and have multiple scenarios a business needs to meet to qualify a quarter in this manner.

- 2020 Quarters, starting Q1 (March 13), Q2, Q3, and Q4.

- For 2020, the maximum amount of an employee's eligible wages that can be counted (based on eligible quarters) for an employee is up to $10k. And the ERC Credit / Refund is 50% of this, or $5k max per employee for all of 2020.

- 2021 Quarters, Q1, Q2, Q3 for existing businesses.

- For 2021, an employee's eligible wages is up to $10k per quarter. And the ERC Credit / Refund is 70% of this, or $7k maximum per employee per quarter. This is a potential maximum of $21k for 2021.

- 2021 Quarter, Q4 only for Start Up Recovery Businesses that started operations during COVID.

- For 2021 Q4, it works the same way as Q1, Q2, Q3. An employee's eligible wages is up to $10k per quarter. And the ERC Credit / Refund is 70% of this, or $7k maximum per employee per quarter. This is a potential maximum of $28k for all four quarters in 2021, for Start Up Recovery Businesses.

- The term "recovery startup business" means any employer- (A) which began carrying on any trade or business after February 15, 2020 , and (B) for which the average annual gross receipts of such employer (as determined under rules similar to the rules under section 448(c)(3) ) for the 3-taxable-year period ending with the taxable year which precedes the calendar quarter for which the credit is determined under subsection (a) does not exceed $1,000,000.

- PPP loans: even if a business received Round 1 and/or Round 2 in PPP loans, a business can still claim the ERC Credit, just not on the same wages. No "double dipping".

- Majority business owners, partners, and principals, plus family members related to these individuals, are not allowed to have owners wages calculated in the ERC Credit, even though they might be on payroll. This applies in most cases.

- There are potentially hundreds of FAQs and scenarios related to the ERC Credit, depending on the business, and number of employees on payroll.

- It's complicated and confusing. Professional assistance is recommended.

Buyer Beware: Employee Retention Credit Companies Charging 15% to 30% of Your ERC Tax Refund

Business owners are reporting receiving many calls and emails from companies claiming to be Employee Retention Credit experts. Some on a daily basis.

A seemingly overnight industry has been created around the Employee Retention Credit. Some ERC companies will have business owners sign lengthy page contracts, will charge no money upfront, and then wait to get paid once the business receives their ERC tax refund check.

What many small business owners do not realize is that they may be overpaying on a grand scale. Some of these fee levels may rival corporate level fee structures, or big company pricing. Yet, for many small business owners, they could be paying 5x to 10x more than they really need to.

While there is nothing wrong with a company charging professional fees for services rendered, some small business owners feel these fees may be very expensive.

There have been numerous instances of small business owners being quoted a percentage of their estimated ERC Employee Retention Credit tax refund. Or, where the fee levels are so excessive, they fall in the range of 15% to 30% of the small business owner's ERC tax refund.

For example, if a business was qualified to receive a $100,000 Employee Retention Credit tax refund, and they engaged with a company charging them 30% (or fee equivalent) of their refund, this would be $30,000 the business owner would be paying.

"In one case, we had a 200+ employee company with 15+ locations come to us. They were quoted $250,000 to do the work on their Employee Retention Credit tax refund, which was anticipated to be just over $1 million. Even though they were a larger small business, they realized that paying $250k for amended tax returns to claim the ERC credit, was well beyond excessive," said Stewart.

IRS Rules Prohibit Companies from Charging a Contingent Fee or Percentage % of a Tax Refund

Even though many companies out there performing ERC services are charging a percentage of a client's Employee Retention Credit refund, they are knowingly, or unknowingly, running afoul of IRS rules and regulations.

The IRS is very clear on this point. It can be found on page 21 of the Regulations Governing Practice before the Internal Revenue Service, Treasury Department Circular No. 230 (Rev. 6-2014), Catalog Number 16586R, under Section 10.27 Fees.

The IRS states, "A practitioner may not charge a contingent fee for services rendered in connection with any matter before the Internal Revenue Service. A contingent fee includes a fee that is based on a percentage of the refund reported on a return, that is based on a percentage of the taxes saved, or that otherwise depends on the specific result attained.

What is "Audit Protection" and Will it Protect You from an IRS Audit?

Many of the same companies charging these excessive percentage-based fees will throw around terms like "audit protection". However, does this really protect you and guarantee you will not get audited by the IRS?

The short answer is no.

If the IRS flags your ERC claim for an audit, there is nothing that will stop the IRS, a federal government agency, from auditing an ERC claim or business tax return, if they chose to do so.

The term "audit protection" is more of a marketing and sales angle to confuse small business owners into thinking their Employee Retention Credit tax refund claim is somehow audit proof.

"If a client's ERC Credit claim for a refund is done accurately, and by-the-book per current IRS rules and guidelines, they can be assured their ERC claim will be on solid ground and they would have nothing to worry about. It's always best to follow the exact IRS rules when determining eligibility and filing amended 941-X returns for claiming an Employee Retention Credit tax refund," said Stewart.

The Employee Retention Credit is Available to Companies and Small Businesses in All 50 States

The Employee Retention Credit is not a state specific payroll credit program. The ERC credit is a federal IRS business tax refund program based on W-2 employee wages paid in 2020 and 2021.

Companies and small businesses in all 50 states are eligible, including:

- Alabama (AL)

- Alaska (AK)

- Arizona (AZ)

- Arkansas (AR)

- California (CA)

- Colorado (CO)

- Connecticut (CT)

- Delaware (DE)

- District of Columbia (DC)

- Florida (FL)

- Georgia (GA)

- Hawaii (HI)

- Idaho (ID)

- Illinois (IL)

- Indiana (IN)

- Iowa (IA)

- Kansas (KS)

- Kentucky (KY)

- Louisiana (LA)

- Maine (ME)

- Maryland (MD)

- Massachusetts (MA)

- Michigan (MI)

- Minnesota (MN)

- Mississippi (MS)

- Missouri (MO)

- Montana (MT)

- Nebraska (NE)

- Nevada (NV)

- New Hampshire (NH)

- New Jersey (NJ)

- New Mexico (NM)

- New York (NY)

- North Carolina (NC)

- North Dakota (ND)

- Ohio (OH)

- Oklahoma (OK)

- Oregon (OR)

- Pennsylvania (PA)

- Rhode Island (RI)

- South Carolina (SC)

- South Dakota (SD)

- Tennessee (TN)

- Texas (TX)

- Utah (UT)

- Vermont (VT)

- Virginia (VA)

- Washington (WA)

- West Virginia (WV)

- Wisconsin (WI)

- Wyoming (WY)

About Disaster Loan Advisors™ Employee Retention Credit (ERC) Services

Disaster Loan Advisors™ (DLA) is a trusted team of financial tax professionals and Employee Retention Credit (ERC) consulting specialists dedicated to saving businesses from lost sales, lost customers, lost revenue due to financial and economic harm caused by the COVID-19 / Coronavirus disaster, Delta and Omicron variants, and other recession and inflation downturns in the economy.

Having worked with over 1500+ business clients navigate the SBA Economic Injury Disaster Loan (EIDL), Paycheck Protection Program (PPP), and Restaurant Revitalization Fund (RRF) programs, DLA further refined its expertise in the ERC Tax Credit program assisting ownership groups with multiple business entities, multiple location business owners, and other complex situations that require an expert strategist to be brought in to assess the situation and create the most strategic path forward.

DLA further specializes in another key pandemic-era SBA / IRS program where business owners are leaving a lot of relief fund money on the table. It is the often misunderstood and confusing Employee Retention Tax Credit (ERC) / Employee Retention Tax Credit (ERTC) program whereby business owners can retroactively receive up to $26,000 back for each W-2 employee they had on payroll for the 2020 and 2021 tax filing years. Done correctly, these tax credits or cash refunds can be claimed retroactively for up to 3 years.

It's encouraged that business owners obtain professional assistance in going through the complex 941-X amended filing process to help your company maximize the full value of the ERC Credit Program, while staying safe and compliant within the complex IRS rules and regulations for claiming the ERC Credits.

DLA doesn't charge a percentage (%) of your ERC refund like many companies are charging. Instead, DLA works on a reasonable professional flat-fee basis. If you are looking for an ERC company that believes in providing professional ERC services and value for small business owners, in exchange for a fair, reasonable, and ethical fee for the amount of work required, Disaster Loan Advisors is a good fit for you.

Need Strategic Employee Retention Credit Guidance?

CONTACT:

Disaster Loan Advisors

Elena Goldstein

Director of Media Relations

877-463-9777 ext. 3

[email protected]

Connect with Disaster Loan Advisors via Social Media:

Linkedin, Facebook, Instagram, Twitter, and CrunchBase.

For a Strategic Exploratory Conversation on the Employee Retention Tax Credit / Refund Program, Visit:

https://www.disasterloanadvisors.com/contact

SOURCE: Disaster Loan Advisors™ (DLA)

View source version on accesswire.com:

https://www.accesswire.com/717315/Employee-Retention-Credit-Tax-Refund-Worth-26k-Per-Employee

These press releases may also interest you

|

News published on and distributed by: