Subject: SBS

First Time Ever: SBA 504 Loan Program's 20-Year Fixed Rate* Dips Below 4% for Borrowers, a Milestone Low-Rate in Program's 33-Year History

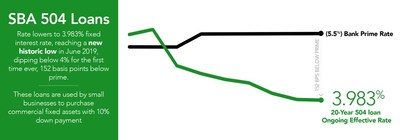

WASHINGTON, June 11, 2019 /PRNewswire/ -- Borrowers of SBA 504 loans this month will be in the first class of small business borrowers with 504 financing fixed at a rate below 4% in the program's history. The 20-year effective rate for the June sale was 3.98%, edging below the 4.01% record set in December 2012. This is the first time a 20-year 504 effective rate calculation has been this low**.

Another standout metric is the 504 rate when compared to the current prime rate. At 152 basis points under the Bank Prime Rate, the June funding is the furthest below prime that 20-year rates have been since May 2007. Even if the Federal Reserve makes the two ¼-point policy rate cuts anticipated by the market this year, the 504 effective rate may remain approximately one full point below prime (not including any additional spread over prime charged by many commercial real estate lenders).

*The 3.98% rate referred to is the current fiscal year effective rate, defined as the 20-year maturity effective rate calculated by the Central Servicing Agent using a 0.625% CDC fee and the borrower fee for the current government fiscal year.

**Based on the current fiscal year borrower fee.

SBA 504 Loan Program

The 504 Loan Program is a U.S. Small Business Administration (SBA) loan program facilitated by SBA-certified development companies (CDCs). Typically, small business borrowers make a 10% down payment, a bank or credit union finances 50% of project costs in the first lien position, and a CDC finances 40% of project cost in the second lien position that is guaranteed by the federal government. This loan program, with 10, 20, and 25-year fixed rate options, is used for commercial fixed assets (land, property, construction, or equipment) with total project costs from approximately $100,000 to approximately $15,000,000.

About the National Association of Development Companies

NADCO is the trade association of certified development companies ? the SBA's certified on-the-ground partners charged with facilitating SBA 504 loans. NADCO represents over 200 CDCs, approximately 95% of the industry, which serves all 50 states. In fiscal year 2018, the SBA approved 5,874 504 loans totaling $4.7 billion.

SOURCE National Association of Development Companies (NADCO)

These press releases may also interest you

|

News published on and distributed by: