Subjects: ERN, MAT

Cannara Biotech Reports Q2 2024 Financial Results

Net revenue, increased to $19.7 million in Q2 2024 from $13.0 million in Q2 2023, a 51.0% increase.

Gross profit, before fair value adjustments, increased to $7.1 million in Q2 2024 from $4.0 million in Q2 2023, a 77.2% increase.

Delivered a twelfth consecutive quarter of positive Adjusted EBITDA1 of $3.5 million.

All financial results are reported in Canadian dollars, unless otherwise stated.

MONTREAL, April 29, 2024 /CNW/ - Cannara Biotech Inc. ("Cannara" or the "Company") (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB0), a vertically integrated producer of premium-grade cannabis and derivative product offerings at affordable prices with two mega facilities based in Quebec spanning over 1,650,000 sq. ft., today announced its fiscal second quarter 2024 financial and operating results for the three and six-month periods ended February 29, 2024. The full set of condensed interim consolidated financial statements for the three and six-month periods ended February 29, 2024, and the accompanying management's discussion and analysis can be accessed by visiting the Company's website at investors.cannara.ca, and/or accessing its profile pages on SEDAR+ at www.sedarplus.ca.

"This past quarter, despite a challenging market environment, Cannara continued to demonstrate continued positive execution towards becoming one of the leading cannabis companies in Canada. With our tenth grow zone now operational, our annual production capability has increased to 33,500 kg, underlining our dedication to increasing capacity to meet the growing market demand for our product," expressed Zohar Krivorot, President & CEO. "Our footprint is expanding robustly across Alberta and BC, bolstered by the introduction of new SKUs and the approval from the Manitoba Liquor & Lotteries Corporation, paving the way for a stronger market presence in Q3 2024. The outpouring of positive feedback from our diverse clientele across Canada reaffirms our success in delivering unparalleled premium quality at affordable pricing. My gratitude goes to our dedicated team, whose relentless pursuit of operational excellence positions Cannara on our strategic objective of becoming Canada's premier cannabis producer."

"I am thrilled to share a remarkable 68% surge in our year-over-year revenues for the six months ended February 29, 2024, a testament to our growing influence in the Quebec, Ontario, Alberta, and BC markets," noted Nicholas Sosiak, CFO. " With a sharp focus on efficiency, we've seen our gross profit margin increase to 36.3% from 30.9%, alongside a notable 8.7% increase in adjusted EBITDA to $3.5 million and free cash flow2 of $1.2 million in Q2 2024 compared to the negative cash flow in the same period of prior year. Some headwinds were faced this quarter, including a net loss of $3.4 million primarily due to non-cash fair value changes, which is expected to reverse next quarter following improvements in our cultivation yields, in addition to a minimum adjusted EBITDA covenant breach on our term loan, for which a waiver was successfully obtained in addition to removing this EBITDA covenant from our term loan conditions for future periods. Our proactive steps towards streamlining assets align with our ambition to fortify our financial foundation as we relentlessly stay focused on gaining market share and becoming the leader in Canada, the second largest cannabis market in the world. As for our long-term vision, we do see our future extend beyond our borders where Cannara is a globally recognized brand synonymous with excellence and value in cannabis."

_____________________________ |

1 Free cash flow is a non-GAAP financial measure. For more details see the see the Non-GAAP Measures, Non-GAAP Ratios and Segment Measures section of this news release. |

2 Free cash flow is a non-GAAP financial measure. For more details see the see the Non-GAAP Measures, Non-GAAP Ratios and Segment Measures section of this news release. |

Fiscal Second Quarter Financial Highlights

- Gross cannabis revenues before excise taxes increased to $26.3 million in Q2 2024 from $15.9 million in Q2 2023, a $10.4 million or 65.4%, increase. The increase is attributable to increase in market share across Canada, as a result of continued growing demand for its products and launch of new SKUs.

- Total revenues, net of excise taxes, increased to $19.7 million in Q2 2024 from $13.0 million in Q2 2023, a $6.7 million or 51.0% increase.

- Gross profit, before fair value adjustments, increased to $7.1 million in Q2 2024 from $4.0 million in Q2 2023, a 77.2% increase.

- Gross profit percentage before fair value adjustments in Q2 2024 was 36.3% compared to 30.9% in Q2 2023.

- Operating loss of $2.0 million in Q2 2024 compared to an operating income of $631,335 in Q2 2023, mainly due to a $3.0 million non-cash net impact of the change in fair value of inventory sold and an unrealized gain on change in fair value of biological assets.

- Net loss was $3.4 million in Q2 2024 compared to a net loss of $618,055 in Q2 2023.

- Adjusted EBITDA increased by 8.7%, from $3.2 million in Q2 2023 to $3.5 million in Q2 2024.

- As at February 29, 2024, the Company breached a minimum adjusted EBITDA covenant on its term loan, which was subsequently waived in addition to amending its credit facility to remove the minimum EBITDA requirement on a going forward basis.

- The Company generated positive operating cash flow amounting to $2.3 million in Q2 2024 compared to $376,962 in Q2 2023.

- Free cash flow for Q2 2024 increased to $1.2 million from $(1.3) million in Q2 2023.

Second Quarter Operational Highlights

- Robust Market Share Growth Across Key Regions:

- Québec: The Company ranks as the 3rd largest licensed producer in Québec, holding approximately 9.0% of the provincial market during Q2 2024. 3

- Alberta: The Company significantly increased its market share in Alberta by 40.6%, from a 2.3% market share in Q1 2024 to 3.2% in Q2 2024.4

- Ontario: In Ontario, Cannara is the 9th top licensed producer by market share, with a 2.98% share of Canada's largest cannabis market5.

- Expansion in Manitoba, Canada: In March 2024, the Company received approval from the Manitoba Liquor & Lotteries Corporation to list its branded cannabis products, with a scheduled market entry in the third quarter of 2024. This development not only diversifies Cannara's geographical footprint but also underscores the Company's commitment to enhancing product accessibility for its customers.

- Innovative Strain Development: February 2024 saw the successful completion of the Company's 2023 pheno-hunt, unveiling three new cannabis strains for Cannara's brand portfolio. Cannara plans to launch two strains under the Tribal brand (Neon Sunshine and Bubble Up) and one under the Nugz brand (Guava Jam).

- Operational Expansion at Valleyfield Facility: As of January 2024, the Cannara activated a tenth growing zone at the Valleyfield Facility, enhancing production capacity to an estimated 33,500 kg of cannabis annually across its operations.

- Sale of Parcel of Land and Building in Construction at Valleyfield Site: In January 2024, the Company's Board of Directors decided to pursue the sale of a currently unused parcel of land, in addition to an adjacent building under construction at its Valleyfield site, which had previously been intended to be leased out. The assets are being actively marketed. On April 24, 2024, the Company received an offer to purchase the parcel of the land at the Valleyfield site for $2.1 million. The transaction is expected to close in the next 10 days.

- SKU Expansion Across Key Canadian Markets: From December 2023 to February 2024, Cannara continued to expand in Québec, Ontario, British Columbia, and Alberta, significantly increasing its SKU offerings from 97 in August 2023 to 132 as of February 2024, reflecting the growing confidence in Cannara's product portfolio among provincial distributors.

- Cannara Enters East-Coast Recreational Market With 4/20 Themed Offer with Nova Scotia Liquor Corporation: Cannara successfully launched its consumer favourite Tribal Cuban Linx pre-rolls with the Nova Scotia Liquor Corporation (NSLC) for a 4/20-themed holiday limited time offer with the potential to expand market offerings in Q3 and Q4 of fiscal year 2024.

- Legislative Changes Boost Global Cannabis Market: Cannara sees a promising future for the cannabis industry with significant legislative changes in Germany and Israel:

- Germany: Effective April 1, 2024, cannabis is legalized for adult use, marking a significant shift in the European market.

- Israel: Despite initial delays due to regional conflicts, the Israeli Ministry of Health announced the phased implementation of a medical cannabis reform, starting April 1, 2024.

Although the main focus of revenues for the Company remains its Canadian client base, Germany and Israel's announced cannabis legalization strategies further validates the potential for increased demand in legal cannabis markets and aligns with Cannara's proven capability to sale at an international level.

_____________________________ |

3 Based on estimated sales data provided by Weed Crawler, for the period of December 2023 to February 2024. |

4 Based on Headset Data for the periods of December 2023 to February 2024 and March 2024. |

5 Trellis Distribution Insights, March 2024. |

Capital Transactions

During the second quarter of 2024, the Company purchased 5,000 common shares having a book value of $4,890 for cash consideration of $4,312. All shares purchased were cancelled.

During the second quarter of 2024, the Company granted a total of 625,000 stock options at an exercise price of $1.20, 99,000 stock options at an exercise price of $1.80 and 715,000 restricted share units to employees and board members, which are subject to certain vesting conditions in accordance with the Company's employee share option and restricted share units plan. During the second quarter of 2024, the Company also extended the term of 2,435,000 stock options exercisable at $1.80 per share and 750,000 stock options exercisable at $1.00 per share by 2 years. Subsequent to quarter-end, the Company granted 25,000 stock options at an exercise price of $1.80 to employees subject to certain vesting conditions in accordance with the Company's employee share option plan.

Security Based Compensation Plans

At the Company's recently held Assembly General Meeting, shareholders approved amendments to the Company's security based compensation plans to ensure conformance with TSX-V Policies by a) specifying that any restricted share units issued must vest a minimum of one year following the grant date, b) indicating that employees must perform a minimum of 20 hours per week for the Company in order to be granted options c) adding additional restrictions to the vesting schedule for options recipients who are investor relations service providers, and d) specifying that shareholder approval only needs to be obtained to extend the options expiry date for insiders as opposed to all option holders.

Outstanding Shares

As at the date of this news release, the Company had 90,018,952 common shares, 4,563,300 stock options and 1,504,183 restricted share units issued and outstanding. The complete Condensed Interim Consolidated Financial Statements and Management's Discussion and Analysis, along with additional information about the Company and all of its public filings that are available at sedarplus.ca and the Company's investor website, investors.cannara.ca.

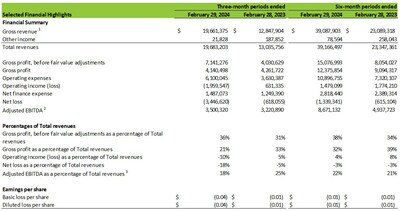

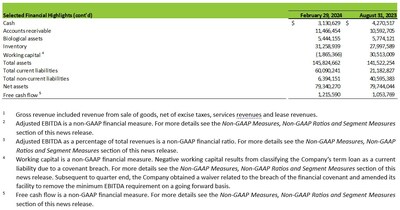

Selected Financial Highlights

Non-GAAP Measures, Non-GAAP Ratios and Segment Measures

The Company reports its financial results in accordance with International Financial Reporting Standards ("IFRS"). Cannara uses a number of financial measures when assessing its results and measuring overall performance. Some of these financial measures are not calculated in accordance with IFRS. National Instrument 52-112 respecting Non-GAAP and Other Financial Measures Disclosure ("NI 52-112") prescribes disclosure requirements that apply to the following types of measures used by the Company: (i) non-GAAP financial measures (ii) non-GAAP financial ratios and (iii) total of segments measures. In this press release, the following non-GAAP financial measures and ratios are used by the Company: adjusted EBITDA, free cash flow, working capital, and adjusted EBITDA as a percentage of total revenues. There are no total of segments measures included in this press release. Additional details for these non-GAAP and other financial measures can be found in the section entitled "Non-GAAP Financial Measures, Non-GAAP Ratios and Segment Measures" of Cannara's MD&A for the three and six-months ended February 29, 2024, which is posted on Cannara's website at www.cannara.ca and filed on SEDAR+ at www.sedarplus.ca. Reconciliations of non-GAAP financial measures and non-GAAP ratios to the most directly comparable IFRS measures are provided below. Management believes that these non-GAAP financial measures and non-GAAP ratios provide useful information to investors regarding the Company's financial condition and results of operations as they provide key metrics of its performance. These measures are not recognized under IFRS, do not have any standardized meanings prescribed under IFRS and may differ from similar computations as reported by other issuers, and accordingly may not be comparable. These measures should not be viewed as a substitute for the related financial information prepared in accordance with IFRS.

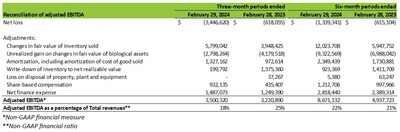

Reconciliation of Adjusted EBITDA

Adjusted EBITDA is a non-GAAP Measure and can be reconciled with net income (loss), the most directly comparable IFRS financial measure, as detailed below.

Adjusted EBITDA as a percentage of total revenues is a non-GAAP financial ratio, determined as adjusted EBITDA divided by total revenues.

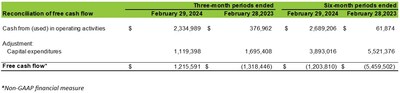

Reconciliation of Free Cash Flow

Free cash flow is a non-GAAP measure and can be reconciled with cash from (used) in operating activities, the most directly comparable IFRS financial measure, as detailed below.

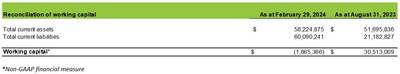

Reconciliation of working capital

Working capital is a non-GAAP Measure and can be reconciled with total current assets and total current liabilities, the most directly comparable GAAP financial measure, as detailed below.

Negative working capital results from classifying the Company's term loan as a current liability due to a covenant breach. Subsequent to quarter end, the Company obtained a waiver related to the breach of the financial covenant and amended its facility to remove the minimum EBITDA requirement on a going forward basis.

About Cannara Biotech Inc.

Cannara Biotech Inc. (TSXV: LOVE) (OTCQB: LOVFF) (FRA: 8CB0) is a vertically integrated producer of affordable premium-grade cannabis and cannabis-derivative products for the Canadian markets. Cannara owns two mega facilities based in Québec spanning over 1,650,000 sq. ft., providing the Company with 100,000 kg of potential annualized cultivation output. Leveraging Québec's low electricity costs, Cannara's facilities produce premium-grade cannabis products at an affordable price. For more information, please visit?cannara.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release may contain "forward-looking information" within the meaning of applicable securities legislation ("forward-looking statements"). These forward-looking statements are made as of the date of this news release and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required under applicable securities legislation. Forward-looking statements relate to future events or future performance and reflect Company management's expectations or beliefs regarding future events and include, but are not limited to, the Company and its operations, its projections or estimates about its future business operations, its planned expansion activities, the adequacy of its financial resources, the ability to adhere to financial and other covenants under lending agreements, future economic performance, and the Company's ability to become a leader in the field of cannabis cultivation, production, and sales.

In certain cases, forward-looking statements can be identified by the use of words such as "plans," "expects" or "does not expect," "is expected," "budget," "scheduled," "estimates," "forecasts," "intends," "anticipates" or "does not anticipate," or "believes," or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might" or "will be taken," "occur" or "be achieved" or the negative of these terms or comparable terminology. In this document, certain forward-looking statements are identified by words including "may," "future," "expected," "intends" and "estimates." By their very nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Such factors include, but are not limited to, the factors discussed in the section "Risk Factors" of the MD&A as well as those factors detailed from time to time in the Company's interim and annual financial statements and the related MD&A of those statements. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

The Company provides no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Historical results of operations and trends that may be inferred from the following discussions and analysis may not necessarily indicate future results from operations.

SOURCE Cannara Biotech Inc.

These press releases may also interest you

|

News published on and distributed by: