Murchison Minerals Concludes Winter Diamond Drill Program, Expands VMS Mineralization (Copper-Zinc-Silver-Lead-Gold) at BMK Deposit

- The 2024 Winter Diamond Drill Program successfully expanded VMS mineralization at the BMK Deposit, demonstrating the Deposit remains open and highly prospective for further expansion and discovery of an associated copper stockwork zone

- The Program comprised four diamond drill holes totaling 2,712 metres

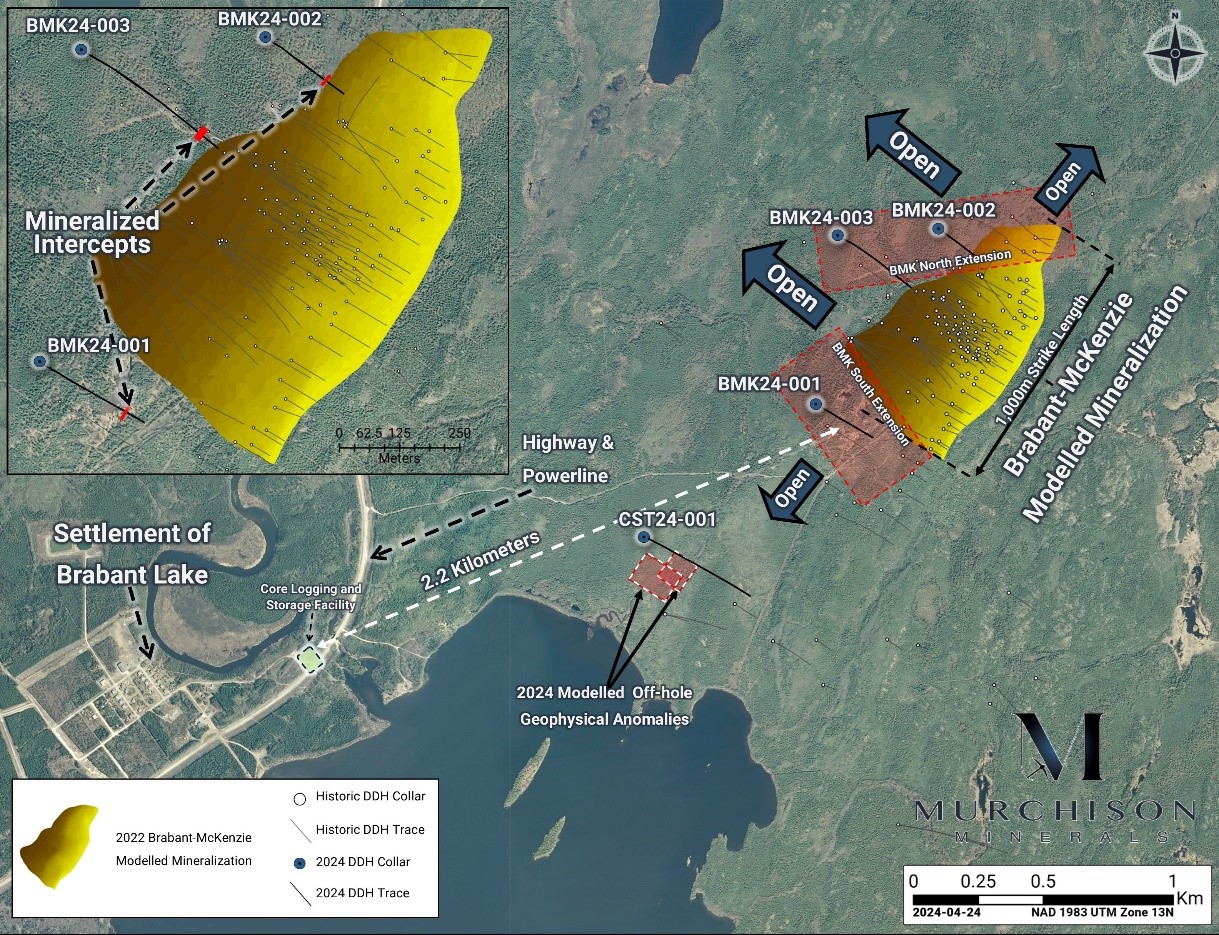

- Four target areas, designed as a first pass across BMK Deposit and proximal anomalies were tested:

- BMK Extension (three targets): one hole each at BMK North and South designed to test along strike from the BMK Deposit, and one hole at BMK Deep which tested below the known extents of the BMK Deposit

- CST, a HeliSAM target, which lies 400 m along strike to the southwest of the BMK Deposit

- BMK North and South Extension Targets - drilling expanded the footprint of mineralization along strike from BMK, highlighted by:

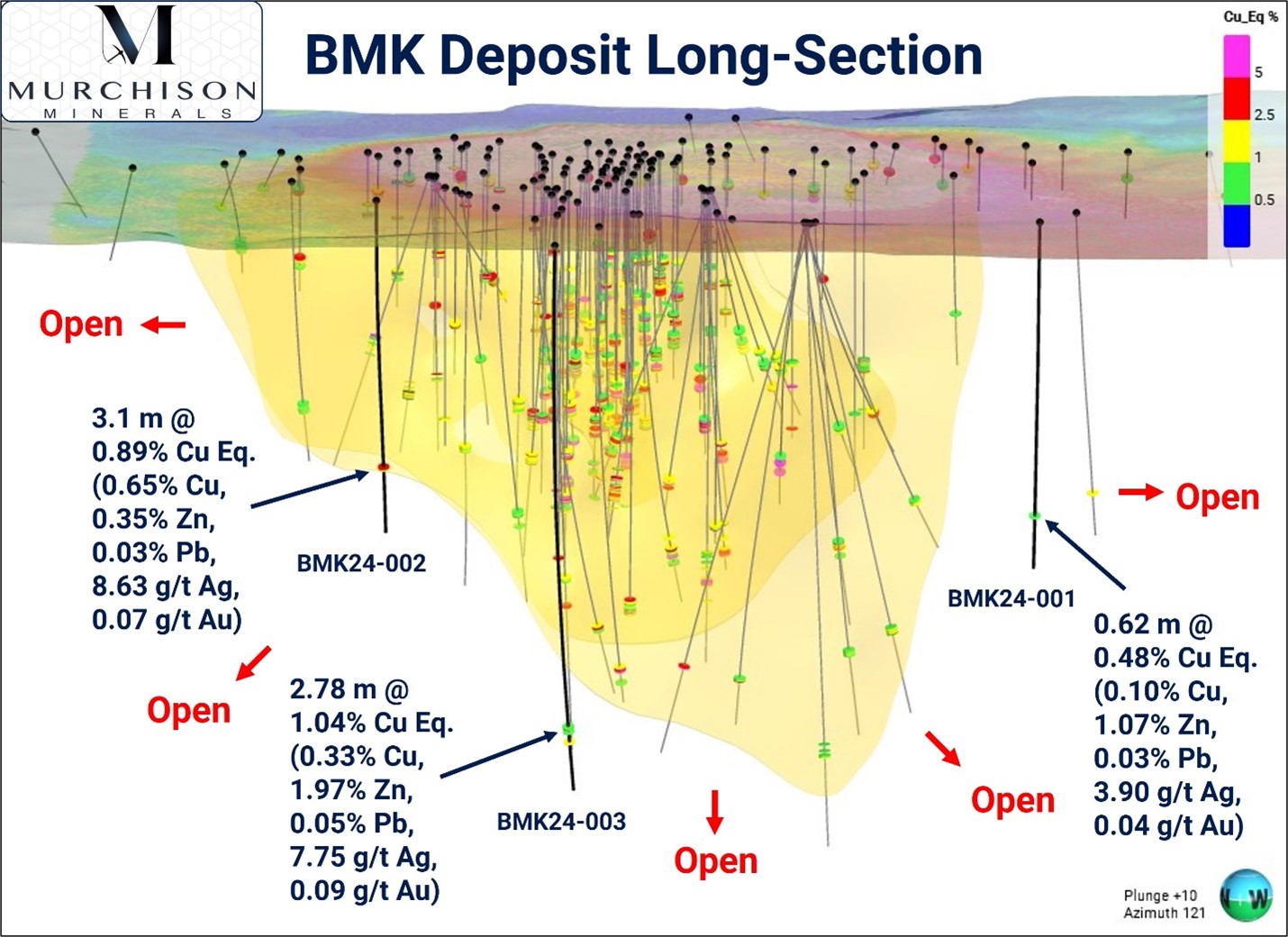

- BMK24-002 intersected mineralization 100 m to the northwest of the Deposit's current footprint, intersecting grades up to 1.96% copper, with a higher copper to zinc ratio indicative of copper stockwork mineralization.

- BMK Deep Extension Target - drilling successfully intersected mineralization at depth below the known extents of the BMK Deposit, highlighted by:

- BMK24-003 intersecting 2.78 m of 1.04% CuEq. 110 m below the known extents of the BMK Deposit.

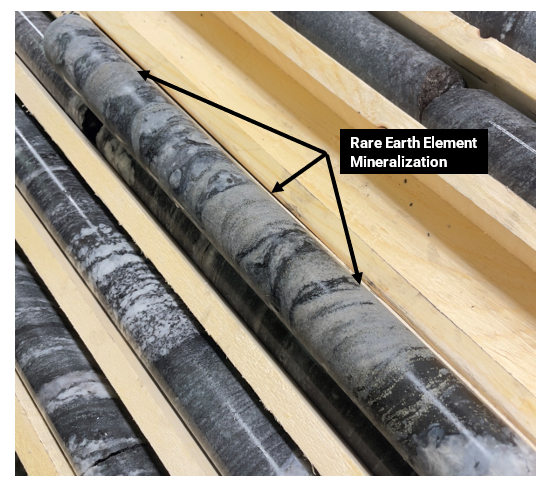

- CST Target - drilling intersected strong VMS alteration, which was later correlated to an off-hole geophysical anomaly identified during a Borehole EM (BHEM) Survey. The alteration associated with the anomaly indicates the CST area remains prospective. Additionally, drilling intersected high-grade rare earth elements (REEs), highlighted by:

- CST24-001 which intersected 7.76% TREO over 0.5 metre, this is the first drill hole on the BMK Project to intersect high-grade REEs and the Company will undertake a review of historic drill holes for possible resampling.

BURLINGTON, ON / ACCESSWIRE / April 29, 2024 / Murchison Minerals Ltd. ("Murchison" or the "Company") (TSXV:MUR)(OTCQB:MURMF) is pleased to announce that it has concluded the 2024 Winter Exploration Program (the "Program") at its 100%-owned Cu-Zn-Ag-Pb-Au Volcanogenic Massive Sulphide (VMS) BMK Project in Saskatchewan. The Program was designed to provide a first pass reconnaissance for the discovery of a potential copper stockwork zone associated with the formation of the BMK Deposit. In total, 2,712 m were completed, comprising four diamond drill holes, which tested four high-priority target areas (one hole at each target area). Three target areas: BMK Deep, North and South followed up on previous drilling at the BMK Deposit, where high-grade copper has been intersected. The fourth target, CST, tested a geophysical anomaly 400 m along strike to the southwest of the BMK Deposit. The three drill holes at the BMK Extension Targets successfully expanded the footprint of VMS mineralization at the BMK Deposit, demonstrating that the Deposit remains open and prospective for further expansion and discovery of an associated copper stockwork zone. Significantly, at BMK North, drill hole BMK24-003 intersected a zone of VMS mineralisation with a high copper to zinc ratio. Similar high copper to zinc ratios have been intersected during previous drill campaigns which targeted the northern extent of the BMK Deposit. The Company is encouraged by these intersections, indicating the potential for a nearby copper stockwork zone proximal to the northern extent of the BMK Deposit. At the CST Target area, drilling intersected a significant interval of VMS type alteration which correlates with an off-hole borehole electromagnetic conductor, indicating the drill hole may have narrowly missed a zone of VMS mineralization. The 2024 Program demonstrates the BMK Deposit remains open for further expansion of VMS mineralization. Additionally, the results from this first pass testing are encouraging for the discovery of an associated copper stockwork zone during future drill campaigns.

Table 1: 2024 BMK Program Highlight Results

Hole ID | From (m) | To (m) | Interval (m) | Cu (%) | Zn (%) | Pb (%) | Au (g/t) | Ag (g/t) | Cu Eq. (%) | Zn Eq. (%) | |

BMK24-001 | 459.2 | 459.82 | 0.62 | 0.10 | 1.07 | 0.03 | 0.04 | 3.90 | 0.48 | 1.69 | |

BMK24-002 | 394.6 | 397.7 | 3.1 | 0.65 | 0.35 | 0.03 | 0.07 | 8.63 | 0.89 | 3.12 | |

Includes | 394.6 | 395.1 | 0.5 | 1.96 | 1.00 | 0.01 | 0.04 | 23.53 | 2.48 | 8.68 | |

BMK24-003 | 724.22 | 727 | 2.78 | 0.33 | 1.97 | 0.05 | 0.09 | 7.75 | 1.04 | 3.62 | |

Includes | 724.71 | 726.13 | 1.42 | 0.54 | 3.11 | 0.07 | 0.03 | 11.73 | 1.57 | 5.51 | |

BMK24-003 | 732 | 733 | 1 | 0.03 | 0.03 | 0.61 | 0.19 | 15.08 | 0.45 | 1.56 | |

BMK24-003 | 748.85 | 749.42 | 0.57 | 0.08 | 1.85 | 0.43 | 0.01 | 18.14 | 0.87 | 3.04 |

* Reported as core length, intervals 90 to 100% true thickness. **Copper Equivalent (Cu Eq.) & Zinc Equivalent (Zn Eq.) values were calculated using the following USD metal prices from April 21, 2024: $4.4883/lb Copper, $1.2828/lb Zinc, $0.9825/lb Lead, $2330.46/Oz Gold, and $27.208/Oz Silver. The following recovery factors were applied to the equivalent values based on preliminary metallurgical work completed in 2021 factoring in optimization: 95% Zn, 85% Cu, 80% Pb, 65% Au, 60% Ag. Please note that copper equivalent is in substitution for zinc equivalent and not in addition to.

Table 2: 2024 CST Rare Earth Element Highlight Result

Hole ID | From (m) | To (m) | Length (m) * | Ce2O3 (%) | Dy2O3 (%) | Gd2O3 (%) | La2O3 (%) | Nd2O3 (%) | Pr2O3 (%) | Sm2O3 (%) | Tb2O3 (%) | Y2O3 (%) | TREO (%)** |

CST24-001 | 581.5 | 581.96 | 0.5 | 3.55 | 0.03 | 0.14 | 1.68 | 1.56 | 0.46 | 0.25 | 0.01 | 0.08 | 7.76 |

*Reported as core length, true thickness unknown. **TREO calculated as Ce2O3 (%) + Dy2O3 (%) + Gd2O3 (%) + La2O3 (%) + Nd2O3 (%) + Pr2O3 (%) + Sm2O3 (%) + Tb2O3 (%) + Y2O3 (%) = TREO (%).

Table 3: Drillhole Information

Hole | Easting UTM* | Northing UTM* | Elevation (m) | Azimuth (°) | Dip (°) | Length (m) |

BMK24-001 | 580256 | 6220839 | 374 | 120 | -67 | 546 |

BMK24-002 | 580727 | 6221513 | 393 | 122 | -70 | 497 |

BMK24-003 | 580339 | 6221490 | 393 | 120 | -70 | 827 |

CST24-001 | 579598 | 6220327 | 366 | 115 | -63 | 842 |

*UTM Projected Coordinate System NAD83 UTM Zone 13N

2024 Winter Drilling:

- CST24-001 was drilled to test the CST geophysical target 400 m southwest of the BMK Deposit. Due to ground conditions, the drill hole shallowed out, deviating significantly from the targeted pierce point intersecting the geophysical anomaly approximately 150 m from its center. A significant zone (over 6 m in length) of garnet-anthophyllite-cordierite-biotite gneiss consistent with alteration observed at the BMK Deposit was intersected at 410 m depth. A subsequent borehole electromagnetic survey was completed on the hole and indicates an off-hole conductive anomaly appears to be associated with the alteration. Multiple graphitic conductors were intersected at depths of 438 m , 463 m and 733 m which partially explain the HeliSAM geophysical response. Additionally, a 0.5 metre spot sample was submitted for REEs analysis associated with a pegmatite (Figure 3) which returned very significant grades of REEs yielding 7.76% TREO (Table 2). The Company considers the presence of such high-grade REEs encouraging and will complete a property wide review of previous drill, grab and outcrop samples for additional occurrences.

- BMK24-001 was drilled to test the BMK South Extension, the hole intersected a narrow interval of mineralization (Table 1) confirming the presence of VMS mineralization south of the Deposit.

- BMK24-002 was drilled to test the BMK North Extension, the hole successfully intersected mineralization 100 m to the northwest of BMK's current footprint, intersecting grades of up to 1.96% copper with mineralization having a high copper to zinc ratio which is indicative of copper stockwork mineralization. These results are considered encouraging, and the Company will focus additional exploration to the north of the Deposit.

- BMK24-003 was drilled to test the extent of the BMK Deposit and the potential for a copper stockwork zone. The hole successfully intersected mineralization 110 m down-dip from the current footprint of the BMK Deposit (Table 1).

Murchison Minerals' Vice-President of Exploration comments:

"While we did not intersect the primary anomaly at CST, the presence of strong VMS alteration similar to what we observe at BMK is encouraging and the association with an off-hole conductor suggests a near miss. We are also excited by the continued presence of high copper ratio mineralization north of the BMK Deposit and it suggests we are continuing to vector into the copper stockwork. Immediately north of the Deposit has seen very limited historic exploration as the area was previously unavailable for staking, those limitations are now removed so we plan to focus our exploration in this area."

QA/QC?

Murchison has implemented and is adhering to a strict Quality Assurance/Quality Control program. NQ-size core was drilled, and mineralized intervals were marked by geologists during core description. The marked intervals were sampled using a core saw, one-half is kept as a witness sample at core facility in Brabant Lake, Saskatchewan and the other assigned a unique number and placed within a plastic bag. The specific gravity of every sample was measured using the mass-in-air / mass-in-water method. Samples were shipped directly to SRC Geoanalytical Labs in Saskatoon, Saskatchewan. The samples were ground and prepared for analysis by the lab using total digestion. Analyzes were performed using ICP-OES for copper, zinc, lead and silver. Gold was analyzed by fire assay. Every 25th sample sent to the lab was a field duplicate (quarter core), blanks and certified reference material were also submitted approximately every 25th sample.?

Qualifying Statement

The foregoing scientific and technical disclosures on the BMK Project have been reviewed by John Shmyr, P.Geo., VP Exploration, a registered member of the Professional Engineers and Geoscientists of Saskatchewan. Mr. Shmyr is a Qualified Person as defined by National Instrument 43-101. The Qualified Person has verified the data disclosed in this release, including sampling, analytical and test data underlying the information contained in this release. Mr. Shmyr consents to the inclusion in the announcement of the matters based on his information in the form and context in which it appears.

Some data disclosed in this News Release relating to sampling and drilling results is historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. In some cases, the data may be unverifiable due to lack of drill core. Mineralization hosted on adjacent and/or nearby and/or geologically similar properties is not necessarily indicative of mineralization hosted on the Company's properties.

About the BMK Project

The BMK Project is located 175 kilometres northeast of La Ronge, Saskatchewan and approximately three kilometres from the community of Brabant Lake. The area is accessed year-round via provincial Highway 102 and is serviced by grid power. The Project hosts the BMK VMS Deposit, and the mineral claims total 664 square kilometres, that cover approximately 37 kilometres of strike length of the favourable BMK trend.The Project contains multiple known mineralized showings such as the Main Lake and Betty Showings and with many identified geophysical conductors that have yet to be drill tested.

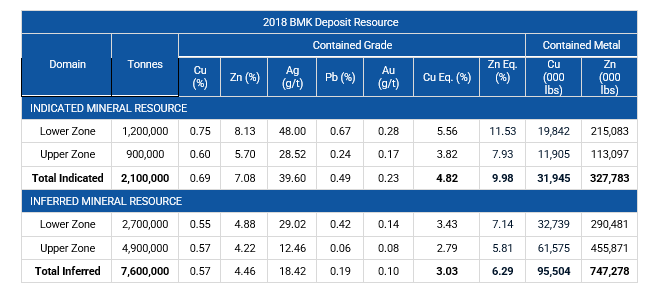

Mineral Resource Summary for BMK VMS Deposit

The above mineral resource estimate for the Brabant-McKenzie VMS Deposit was prepared by an independent qualified person ("QP") Finley Bakker, P. Geo., and has an effective date of September 4, 2018. The NI 43-101 Technical Report named Technical Report on the Resource Estimate Update for the Brabant-McKenzie Property, Brabant Lake, Saskatchewan is available on the Company's website and on SEDAR. The Mineral Resource of the Brabant-McKenzie VMS Deposit was estimated based on metal prices of USD $1.20/lb Zn, $2.50/lb Cu, $1.00/lb Pb, $16.00/Oz. Ag, and $1,200/Oz. Au, and a USD exchange rate of $1.25. A Net Smelter Return (NSR) cut-off of $90/tonne and a 3.5% zinc equivalent based on above metal prices and an average recovery of 75% for all metals.

About Murchison Minerals Ltd. (TSXV: MUR, OTC: MURMF)

Murchison is a Canadian?based exploration Company focused on development of the 100% - owned BMK zinc?copper?silver Project in north?central Saskatchewan and the nickel-copper-cobalt exploration at the 100% - owned HPM Project in Quebec.

Additional information about Murchison and its exploration projects can be found on the Company's website at www.murchisonminerals.ca. For further information, please contact:

Troy Boisjoli, President and CEO,

Erik H Martin, CFO, or

Justin LaFosse, Director Corporate Development

Tel: (416) 350?3776

[email protected]

Forward?Looking Information

The content and grades of any mineral deposits at the Company's properties are conceptual in nature. There has been insufficient exploration to define a mineral resource on the property and it is uncertain if further exploration will result in any target being delineated as a mineral resource.

Certain information set forth in this news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties. This forward-looking information is subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including, but not limited to, the impact of general economic conditions, industry conditions, and dependence upon regulatory approvals. FLI herein includes, but is not limited to: future drill results; stakeholder engagement and relationships; parameters and methods used with respect to the assay results; the prospects, if any, of the deposits; future prospects at the deposits; and the significance of exploration activities and results. FLI is designed to help you understand management's current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this press release is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained herein to reflect new events or circumstances, except as may be required by law. Unless otherwise noted, this press release has been prepared based on information available as of the date of this press release. Accordingly, you should not place undue reliance on the FLI or information contained herein. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI. Assumptions upon which FLI is based, without limitation, include: the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the deposits; the accuracy of key assumptions, parameters or methods used to obtain the assay results; the ability of the Company to obtain required approvals; the results of exploration activities; the evolution of the global economic climate; metal prices; environmental expectations; community and nongovernmental actions; and any impacts of COVID-19 on the deposits, the Company's financial position, the Company's ability to secure required funding, or operations. Risks and uncertainties about the Company's business are more fully discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedar.com. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Murchison Minerals Ltd.

View the original press release on accesswire.com

These press releases may also interest you

|

News published on and distributed by: