Subjects: SVY, VEN

Investor Activity Surpasses 2021 Engagement Levels, Hits Q1 Record High According to DocSend 2024 Data

Investors and founders are busier, showing significant quarterly and yearly growth in future dealmaking metrics

SAN FRANCISCO, April 11, 2024 /PRNewswire/ -- DocSend, a secure document sharing platform and Dropbox (NASDAQ: DBX) company, today released a data analysis showing that investor pitch deck engagement was higher for most of Q1 than all six previous years tracked ? including record-breaking 2021 ? according to its Pitch Deck Interest (PDI) metrics. Investor activity hit a weekly Q1 record high, spiking by 21.7% in early March. Founder pitch deck supply surged by over 20% compared to Q1 2021, signaling fertile ground for VCs looking to invest.

Market Reawakening: Investor Activity Accelerates

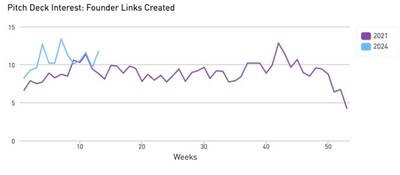

Both founder and investor activity rose in Q1 2024 following a slow 2023 and Q4's ramp-up. Investor engagement with pitch decks is outpacing the rate of founder pitch decks sent out, both year-over-year (YoY) and quarter-over-quarter (QoQ), demonstrating decreased competition in a crowded landscape as VCs prepare to make deals.

Investor pitch deck interactions increased by 17.8% YoY in Q1, and the rate at which founders distributed pitch decks increased by 9.2%. Investors continue to review pitch decks at a quick pace of 2 minutes and 30 seconds, evaluating opportunities and making decisions promptly, despite the shifting temperament of dealmaking over the last few years.

The start of 2024 is showing promise for dealmaking, with a 17.3% rise QoQ in pitch deck interactions. This increased momentum contrasts with 2023 when global venture funding fell to roughly $345 billion, down from $531 billion in 2022.

VC Metrics Reach 2021 Levels with Surging Investor Interest

As the 2024 fundraising landscape evolves, the current fundraising climate is on pace with the fervor of record-breaking 2021.

"Investors appear to be as enthusiastic as they were during the bullish 2021 fundraising climate," said Justin Izzo, senior data and trends analyst at Dropbox DocSend. "Many things have changed during this level-set, as investors practice a more poised due diligence and focus their excitement on disruptive companies that hold long-term promise. If this momentum continues, it could make way for a founder-friendly market later in the year."

Opportunities are rising for VCs, with potential interest rate cuts on the horizon and the current AI industry boom ? investment in AI more than doubled from 2022 to 2023.

"The market is gravitating towards startups that offer not just innovation, but also practical, scalable models and the traction to prove it," said Darrel Frater, senior associate at Serac Ventures. "We've seen founders come forward with pitches that are ambitious but also realistic, emphasizing sustainable business practices. We may not see funding levels approach those of 2021, but the pathway to get there seems possible given renewed interest in VC from limited partners. If managers are able to successfully raise from LPs in this climate, founders will see more capital flowing to their companies."

DocSend releases quarterly data analyses via the Pitch Deck Interest metrics to track and predict the investment landscape, informing founders of volatility or stability in the venture capital environment.

Key Leading Indicators of Fundraising Activity

There are three core metrics unique to DocSend for tracking investors' hunger for deals and founders' quest for capital.

- Founder links created: the average number of pitch deck links each founder is creating via DocSend. This serves as a proxy for the supply of startups seeking funding. A "link" refers to the unique URL a founder creates using DocSend to share their pitch deck with investors. When the average number of links increases, it means that founders are sending their decks out to more investors.

- Investor deck interactions: the average number of investor interactions for each pitch deck link. This serves as a proxy for demand for investments. The higher the interaction metric, the more often decks are viewed, shared, and revisited by potential investors.

- Investor time spent: the average time spent per pitch deck by potential investors. This metric offers a look at how long VCs are spending reviewing deals. More time spent per deck could mean investors are more closely scrutinizing deals.

About DocSend

DocSend enables companies to share business-critical documents with ease and get real-time actionable feedback. With DocSend's security and control, startup founders, investors, executives, and business development professionals can build business partnerships that have a lasting impact. Over 30,000 customers of all sizes use DocSend today. Learn more at docsend.com.

About Dropbox

Dropbox is one place to keep life organized and keep work moving. With more than 700 million registered users across 180 countries, we're on a mission to design a more enlightened way of working. Dropbox is headquartered in San Francisco, CA. For more information on our mission and products, visit dropbox.com.

Media Contact:

Carol Boyko

104 West for DocSend

[email protected]

SOURCE DocSend

These press releases may also interest you

|

News published on and distributed by: