Subject: ERN

Ballard Reports Q2 2018 Results

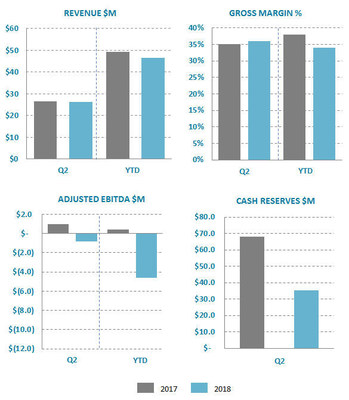

- Revenue of $26.4M, 36% Gross Margin and ($0.8)M Adjusted EBITDA

- Order Backlog expansion to $283.3M at June 30, 2018

VANCOUVER, Aug. 1, 2018 /PRNewswire/ - Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) today announced consolidated financial results for the second quarter ended June 30, 2018. All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (IFRS).

Randy MacEwen, President and CEO said, "Financial results and new contract bookings for Q2 and year-to-date are consistent with the type of first half to the year we had expected. We delivered Q2 revenue of $26.4 million, gross margin of 36% and Adjusted EBITDA of ($0.8) million. We are excited to have ended the quarter with a record Order Backlog of $283.3 million."

Mr. MacEwen also noted, "The global megatrend of electrification of propulsion systems is accelerating. This megatrend is driving growing interest in fuel cell electric vehicles, or FCEVs, for transportation applications where long range, rapid refueling, heavy payload and route flexibility are customer requirements. Interest and customer engagement continues to build in heavy-duty motive applications, including bus, truck, rail and marine, along with automotive, material handling and unmanned vehicle applications. During Q2, we were particularly excited with the long-term extension, through to August 2022, of our HyMotion program with AUDI AG, in support of its automotive fuel cell strategy and deployment plans."

Mr. MacEwen concluded, "As we look out to 2019 and beyond, and to our pathway to profitability, we expect strong growth in FCEV demonstration programs and commercial scaling in certain heavy and medium duty applications in China, Europe and the United States. With continued investment in technology, products, customer engagement and our brand, we see Ballard having a leading position in these large and growing addressable markets."

Q2 2018 Financial Highlights

(all comparisons are to Q2 2017 unless otherwise noted)

- Revenue was $26.4 million, flat on a year-over-year basis, reflecting growth in Power Products, offset by a decline in Technology Solutions due primarily to the strong contribution in Q2 2017 from one-time technology transfer and related agreements with the company's joint venture in China.

- The Power Products platform generated revenue of $17.8 million, an increase of 18%:

- Heavy Duty Motive revenue was $13.3 million, an increase of 9% related primarily to increased product shipments to China, Europe and North America;

- The Portable Power business generated $2.4 million, an increase of 170% due to Power Manager product orders from military customers;

- Material Handling revenue was $1.7 million, a decline of 13% primarily due to the continued in-housing of stack supply by a key customer, combined with lower average selling price resulting from a shift in product mix; and

- Telecom Backup Power revenue was $0.4 million, an increase of $0.3 million resulting primarily from sales in Europe for a variety of backup power installations.

- The Technology Solutions platform generated revenue of $8.6 million, a decrease of 24% due primarily to the strong contribution in Q2 2017 from one-time technology transfer and related agreements with the company's joint venture in China, partially offset by increases in amounts earned from other programs.

- Gross margin was 36%, a 1-point improvement reflecting revenue mix.

- Cash operating costs2 were $10.5 million, an increase of 24% primarily attributable to higher research and product development expenses.

- Adjusted EBITDA2 was ($0.8) million in Q2, a decline of 180% or $1.8 million, primarily driven by higher operating costs.

- Net loss was ($4.3) million, a decline of $3.1 million.

- Net loss per share was ($0.02) compared to ($0.01) in Q2 2017.

- Adjusted net loss2 was ($4.3) million, a decline of $3.9 million.

- Adjusted net loss per share2 was ($0.02) compared to ($0.00) in Q2 2017.

- Cash used by operating activities was ($16.9) million, a decline of $18.7 million reflecting cash operating loss of ($1.6) million and use in working capital of ($15.3) million, largely associated with an increase in accounts receivable and increased inventory to support expected deliveries in the second half of this year.

- Cash reserves were $35.2 million at June 30, a decrease of 48% from the end of Q2 2017 and a decrease of 33% from the end of the prior quarter, primarily due to an increase in working capital in the quarter.

- During Q2 Ballard received $87.7 million in new orders and also delivered orders valued at $26.4 million, thereby significantly increasing Order Backlog from $222.0 million in the prior quarter, to $283.3 million at end-Q2. The 12-month Order Book also increased from $89.0 million in the prior quarter, to $96.0 million at end-Q2.

Q2 2018 Highlights

Bus

- Received a purchase order from Van Hool NV for 40 FCveloCity®-HD modules to power buses planned for deployment in Germany under the Joint Initiative for hydrogen Vehicles across Europe (JIVE) funding program.

- Subsequent to the quarter, announced that El Dorado National's 40-foot Axess fuel cell bus, powered by Ballard's FCveloCity®-HD module, successfully completed testing at The Altoona Bus Research and Testing Center in Pennsylvania under a program established by the Federal Transit Administration (FTA), making them ready for large-scale deployments under FTA funding.

Marine

- Signed a Memorandum of Understanding with ABB to undertake collaboration activities toward the development of megawatt (MW) scale proton exchange membrane fuel cell power systems for the marine market, with an initial focus on the cruise ship segment.

- Ballard Power Systems Europe became a member of a consortium that has received funding to design and build HySeas III, the world's first sea-going renewables-powered car and passenger ferry. Operation of the ferry is planned in the Orkney Archipelago, located off the northeastern coast of Scotland.

- Two FCveloCity®-MD modules were successfully integrated and tested in a hybrid marine application by a consortium including Yanmar Co. Ltd. as part of a program to develop safety guidelines for hydrogen fuel cell-powered boats operating in Japan's restricted coastal waters. The modules were previously provided to Yanmar by Toyota Tsusho Corporation under a Distribution Agreement with Ballard.

Automotive

- Signed a 3½-year extension to the long-term Technology Solutions contract with AUDI AG, part of the Volkswagen Group, extending the HyMotion program from March 2019 to August 2022. The aggregate value of the contract extension, which supports AUDI AG through its small series production launch, is expected to be C$80-130 million (US$62-100 million).

Material Handling

- Signed a multi-year Master Supply Agreement with Hyster-Yale Group encompassing the supply of minimum annual volumes of FCgen®-1020 air-cooled fuel cell stacks for use in powering Class-3 forklift trucks, as well as support on the design of a fuel cell electric propulsion system to power these lift trucks.

Unmanned Vehicles

- Ballard's subsidiary, Protonex, received purchase orders from the U.S. Navy for a total of 13 fuel cell propulsion systems for unmanned aerial vehicle (UAV) or drone platforms, with deliveries expected to occur in 2018.

- Announced a Protonex collaboration program with Cellula Robotics to demonstrate a fuel cell for long range autonomous underwater vehicles, funded by an award on behalf of Canada's Department of National Defence.

Power Manager

- Protonex received a $1.0 million order for the supply of SPM-622 Power Manager Kits to support U.S. Army brigades deploying overseas.

Other

- Subsequent to Q2, acquired certain strategic assets of Automotive Fuel Cell Cooperation Corporation (AFCC), a private company owned by Daimler AG and Ford Motor Company, enabling Ballard to efficiently and rapidly accelerate production growth objectives.

- Toyota Tsusho Corporation sold 5 FCgen®-H2PM backup power systems under its Distribution Agreement with Ballard, to be used as part of Japan's renewable emergency power system installed under the "Soma Revitalization Smart Community Construction Project".

- All items were approved by shareholders at the June 6th Annual General Meeting. Mr. James Roche was subsequently appointed by the company's board of directors to the role of Chairman, succeeding Mr. Ian Bourne. Consistent with board term limits, Mr. Bourne did not stand for re-election as a director.

Q2 2018 Financial Summary

|

(Millions of U.S. dollars) |

Three months ended June 30, |

Six months ended June 30, | |||||

|

2018 |

2017 |

% Change |

2018 |

2017 |

% Change | ||

|

GROWTH |

|||||||

|

Fuel Cell Products & Services Revenue:1 |

|||||||

|

Heavy Duty Motive |

$13.3 |

$12.2 |

9% |

$22.6 |

$19.4 |

17% | |

|

Portable Power |

$2.4 |

$0.9 |

170% |

$4.8 |

$2.1 |

129% | |

|

Material Handling |

$1.7 |

$2.0 |

-13% |

$2.1 |

$4.2 |

-49% | |

|

Backup Power |

$0.4 |

$0.1 |

248% |

$0.7 |

$0.7 |

10% | |

|

Sub-Total |

$17.8 |

$15.2 |

18% |

$30.2 |

26.3 |

15% | |

|

Technology Solutions |

$8.6 |

$11.3 |

-24% |

$16.3 |

$22.9 |

-29% | |

|

Total Fuel Cell Products & Services Revenue |

$26.4 |

$26.5 |

0% |

$46.5 |

$49.2 |

-5% | |

|

PROFITABILITY |

|||||||

|

Gross Margin $ |

$9.4 |

$9.3 |

2% |

$16.0 |

$18.8 |

-15% | |

|

Gross Margin % |

36% |

35% |

1-point |

34% |

38% |

-4-points | |

|

Operating Expenses |

$12.5 |

$10.2 |

23% |

$25.2 |

$22.2 |

14% | |

|

Cash Operating Costs2 |

$10.5 |

$8.5 |

24% |

$21.2 |

$18.4 |

15% | |

|

Adjusted EBITDA2 |

($0.8) |

$1.0 |

-180% |

($4.6) |

$0.4 |

-1,403% | |

|

Net Income (Loss) |

($4.3) |

($1.2) |

-260% |

($9.8) |

($4.1) |

-138% | |

|

Earnings Per Share |

($0.02) |

($0.01) |

-252% |

($0.06) |

($0.02) |

-154% | |

|

Adjusted Net Income (Loss)2 |

($4.3) |

($0.4) |

-1,068% |

($9.8) |

($3.3) |

-197% | |

|

Adjusted Net Loss Per Share2 |

($0.02) |

($0.00) |

-1,050% |

($0.06) |

($0.02) |

-218% | |

|

CASH |

|||||||

|

Cash Provided (Used) by Operating Activities: |

|||||||

|

Cash Operating Income (Loss) |

($1.6) |

$1.4 |

-216% |

($4.4) |

$0.2 |

-2,086% | |

|

Working Capital Changes |

($15.3) |

$0.4 |

-4,072% |

($19.7) |

($1.5) |

-1,199% | |

|

Cash Provided (Used) By Operating Activities |

($16.9) |

$1.8 |

-1,040% |

($24.1) |

($1.3) |

-1,764% | |

|

Cash Reserves |

$35.2 |

$68.1 |

-48% |

||||

For a more detailed discussion of Ballard Power Systems' second quarter 2018 results, please see the company's financial statements and management's discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Conference Call

Ballard will hold a conference call on Thursday, August 2, 2018 at 8:00 a.m. Pacific Time (11:00 a.m. Eastern Time) to review second quarter 2018 operating results. The live call can be accessed by dialing +1.604.638.5340. Alternatively, a live audio and slide webcast can be accessed through a link on Ballard's homepage (www.ballard.com). Following the call, the audio webcast and presentation materials will be archived in the Earnings, Interviews & Presentations area of the Investors section of Ballard's website (www.ballard.com/investors).

About Ballard Power Systems

Ballard Power Systems (NASDAQ: BLDP; TSX: BLDP) provides clean energy products that reduce customer costs and risks, and helps customers solve difficult technical and business challenges in their fuel cell programs. To learn more about Ballard, please visit www.ballard.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements concerning projected revenue growth, product shipments, gross margin, Adjusted EBITDA, cash operating expenses and product sales. These forward-looking statements reflect Ballard's current expectations as contemplated under section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any such statements are based on Ballard's assumptions relating to its financial forecasts and expectations regarding its product development efforts, manufacturing capacity, and market demand. For a detailed discussion of the factors and assumptions that these statements are based upon, and factors that could cause our actual results or outcomes to differ materially, please refer to Ballard's most recent management discussion & analysis. Other risks and uncertainties that may cause Ballard's actual results to be materially different include general economic and regulatory changes, detrimental reliance on third parties, successfully achieving our business plans and achieving and sustaining profitability. For a detailed discussion of these and other risk factors that could affect Ballard's future performance, please refer to Ballard's most recent Annual Information Form. These forward-looking statements are provided to enable external stakeholders to understand Ballard's expectations as at the date of this release and may not be appropriate for other purposes. Readers should not place undue reliance on these statements and Ballard assumes no obligation to update or release any revisions to them, other than as required under applicable legislation.

|

Endnotes: |

|

1 We report our results in the single operating segment of Fuel Cell Products and Services. Our Fuel Cell Products and Services segment consists of the sale and service of PEM fuel cell products for our power product markets of Heavy Duty Motive (consisting of bus, truck, rail and marine applications), Portable Power, Material Handling and Backup Power, as well as the delivery of Technology Solutions, including engineering services, technology transfer and the license and sale of our extensive intellectual property portfolio and fundamental knowledge for a variety of fuel cell applications. |

|

2 Note that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss), are non GAAP measures. Non GAAP measures do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Ballard believes that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) assist investors in assessing Ballard's operating performance. These measures should be used in addition to, and not as a substitute for, net income (loss), cash flows and other measures of financial performance and liquidity reported in accordance with GAAP. For a reconciliation of Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) to the Consolidated Financial Statements, please refer to Ballard's Management's Discussion & Analysis. |

|

Cash Operating Costs measures operating expenses excluding stock based compensation expense, depreciation and amortization, impairment losses or recoveries on trade receivables, restructuring charges, unrealized gains or losses on foreign exchange contracts, acquisition costs and financing charges. EBITDA measures net loss attributable to Ballard Power Systems Inc. excluding finance expense, income taxes, depreciation of property, plant and equipment, and amortization of intangible assets. Adjusted EBITDA adjusts EBITDA for stock based compensation expense, transactional gains and losses, asset impairment charges, unrealized gains or losses on foreign exchange contracts, finance and other income, and acquisition costs. Adjusted Net Income (Loss) measures net income (loss) attributable to Ballard from continuing operations, excluding transactional gains and losses, asset impairment charges, and acquisition costs. |

SOURCE Ballard Power Systems Inc.

These press releases may also interest you

|

News published on and distributed by: